Nearly two-thirds of major U.S. retail websites deliver inadequate mobile performance during the most critical shopping period of the year, according to analysis released December 9, 2025. The comprehensive study examined over 350 of the largest online retailers across 12 sectors, revealing systematic failures in page speed, responsiveness, and accessibility metrics that threaten billions in holiday revenue.

The US Site Speed Report, published by hosting provider 20i, found 65% of retail websites fail Core Web Vitals assessments on mobile devices, compared with 53% failing on desktop platforms. Across all devices combined, 58.2% of analyzed brands failed to meet Google’s performance thresholds for user experience. The findings arrive weeks after major website crashes disrupted Black Friday shopping, demonstrating that technical infrastructure weaknesses persist despite retailers’ awareness of mobile dominance in consumer behavior.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

“Our analysis shows that many U.S. retailers still need to improve mobile performance before the holiday rush,” according to Lloyd Cobb, director at 20i. “Mobile is now the dominant way consumers shop. A slow mobile site isn’t just frustrating, it’s one of the fastest ways to lose customers and revenue during peak shopping periods.”

Researchers utilized Google’s PageSpeed Insights tool to analyze Core Web Vitals data measuring page speed and accessibility. The methodology created weighted index scores out of 700 for each sector based on seven metrics: overall Core Web Vitals pass/fail assessment, Largest Contentful Paint measuring main content loading speed, Interaction to Next Paint measuring page reaction speed, Cumulative Layout Shift measuring layout stability, First Contentful Paint measuring initial visible content appearance, Time to First Byte measuring server response, and accessibility scores rating overall usability.

The mobile performance gap carries substantial commercial implications. Over half of Americans who browse internet content do so via mobile devices, at 57% according to the study. With consumers spending over $1 trillion online in 2024, performance failures directly impact conversion rates during the concentrated November through December shopping period. Research indicates 70% of online shopping carts were abandoned in 2024, with 17% attributed specifically to website crashes.

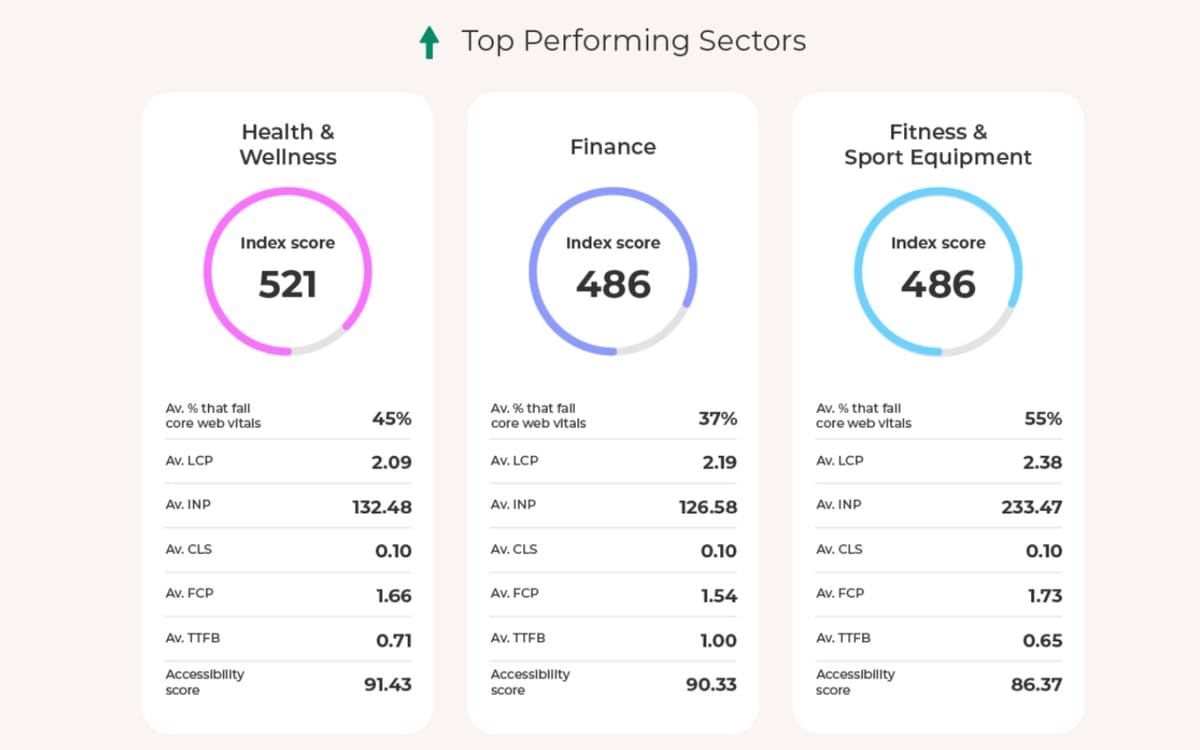

Health and wellness retailers demonstrated the strongest overall performance, achieving a 55% pass rate on Core Web Vitals assessments. These websites averaged Interaction to Next Paint of 132 milliseconds indicating excellent responsiveness, and Largest Contentful Paint of 2.09 seconds representing the fastest content loading among all analyzed sectors. The accessibility score of 91 out of 100 exceeded industry averages.

Financial services ranked second with 62.5% of sites passing Core Web Vitals assessments, the highest rate among all examined sectors. Covering rewards programs and alternative payment platforms that experience elevated traffic before major shopping events, finance websites averaged Interaction to Next Paint of 126 milliseconds, Largest Contentful Paint of 2.19 seconds, and accessibility scores of 90.

The fitness sector placed third despite seeing heavy traffic around Black Friday as shoppers pursue equipment purchases. Average Time to First Byte reached 0.65 seconds, while Interaction to Next Paint of 122 milliseconds and Largest Contentful Paint of 2.38 seconds demonstrated strong interactivity and loading speed. Pet market retailers ranked fourth, achieving the lowest Cumulative Layout Shift score at 0.07 seconds and accessibility rating of 81.5, indicating visual stability and navigation ease. However, moderate loading times from First Contentful Paint and Largest Contentful Paint scores of 1.93 seconds and 2.64 seconds respectively may frustrate users.

Fashion and clothing websites ranked fifth with Interaction to Next Paint of 185 milliseconds, Largest Contentful Paint of 2.26 seconds, and accessibility approaching 90. The sector maintains pressure to improve these metrics ahead of holiday traffic surges.

Retail and wholesale operations posted the weakest overall performance, with 76% failing Core Web Vitals assessments. Sites demonstrated Interaction to Next Paint of 214 milliseconds and First Contentful Paint of 2.05 seconds, indicating moderate responsiveness with significant improvement opportunities. The sector showed weakness across six of seven measured metrics, despite facing the year’s highest traffic volumes.

Travel and tourism ranked second-lowest with Interaction to Next Paint reaching 261 milliseconds and Cumulative Layout Shift of 1.7 seconds, the highest measured values indicating substantial lag and layout instability. The performance gaps appear incongruous for an industry generating trillions of dollars annually. Accessibility scores reached 88, enabling booking functionality for users willing to endure loading delays.

Beauty and personal care retailers saw 72% of sites fail Core Web Vitals despite consistent high spending volumes around Black Friday and Christmas. Analysis identified improvement needs in content loading speed with Largest Contentful Paint at 2.35 seconds, layout stability showing Cumulative Layout Shift of 0.11 seconds, and server response time measured at Time to First Byte of 0.95 seconds. Navigation accessibility scored 93, but performance lags risk losing engaged shoppers.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Streaming services struggle with site speed despite experiencing sustained high traffic and expecting seasonal surges. Platforms including Netflix and HBO demonstrated Interaction to Next Paint of 210 milliseconds indicating slight interaction lag, and average First Contentful Paint of 1.9 seconds reflecting delays before content appears. With 83% of Americans watching streaming platforms, particularly during family gatherings around holidays, convenience expectations leave minimal tolerance for loading delays. The sector maintains discounted promotional rates around Black Friday to sustain competitiveness.

Electronics retailers completed the five worst-performing sectors despite experiencing traffic surges as shoppers await Black Friday discounts on appliances. Average First Contentful Paint of 1.91 seconds and Largest Contentful Paint of 2.53 seconds showed slight loading delays, though accessibility scores of 89 ensured smooth navigation for engaged users.

Accessibility measurements revealed systematic shortcomings across analyzed sectors. The average accessibility score reached 87 out of 100, falling below the recommended best practice threshold of 89. Health and wellness websites scored highest at 91, while retail and wholesale posted the lowest rating at 70. Around one in four U.S. adults lives with a disability affecting digital access, according to the report, making accessibility a major commercial concern as it can drive shoppers away during checkout.

The performance analysis connects directly to Google’s search ranking mechanisms. Core Web Vitals function as ranking signals in Google’s algorithm, with Largest Contentful Paint representing the most significant connection between loading speed and search performance. Technical optimization efforts targeting these metrics have become standard practice for publishers, though results vary considerably across implementations.

The mobile-desktop performance disparity reflects widespread challenges in responsive design and mobile-specific optimization. Average accessibility scores remained nearly identical between platforms at 86.9 on mobile devices compared with 87.1 on desktop, showing consistent accessibility implementation regardless of device. However, the 12-percentage-point gap in Core Web Vitals failure rates between mobile and desktop indicates many brands struggle to deliver strong performance on smaller screens during busy shopping periods.

Younger consumer generations demonstrate significantly shorter attention spans, averaging just eight seconds for Generation Z according to research cited in the report. These behavioral patterns intensify the commercial impact of slow-loading websites. Pages that fail to render critical content within seconds risk losing visitors before product information appears. The correlation between performance and abandonment becomes particularly acute during limited-time promotional events when consumers compare offers across multiple retailers simultaneously.

The timing of the analysis, conducted in October 2025, positioned the research to capture retailer preparation status ahead of Thanksgiving, Black Friday, and Christmas shopping periods. Historical patterns show retailers experience concentrated demand during these promotional windows, with September spending often declining as consumers preserve budgets before holiday purchases. Recent data showed November retail sales increased 4.53% year-over-year with relatively flat monthly growth of 0.12%, suggesting consumers moderated spending ahead of promotional events.

Consumer behavior research indicated 34% of shoppers began holiday purchasing in October or earlier, with 71% citing tariff-related price concerns as their primary motivation. This early shopping activity creates extended pressure on website infrastructure compared with historical patterns concentrated around specific promotional dates. Survey data from October 16, 2025 showed consumers planned to spend $890.49 per person on average for holiday gifts, food, decorations and seasonal items, representing the second-highest amount in the survey’s 23-year history.

The study documented specific technical recommendations for retailers seeking performance improvements before peak shopping periods. Suggestions included optimizing images to reduce file sizes, reducing unnecessary plugins that add processing overhead, testing mobile performance across devices and connection speeds, and selecting reliable hosting infrastructure capable of handling traffic spikes. Additional guidance emphasized pre-caching strategies, database optimization, Redis object caching implementation, and performance testing protocols.

Recent cases have illustrated the business impact of performance optimization failures. An SEO agency experienced a 20% traffic decline after implementing lazy loading across all website images for a client, despite achieving PageSpeed score improvements from 65 to 92. The site’s Largest Contentful Paint deteriorated from 1.8 seconds to 4.2 seconds when lazy loading was incorrectly applied to hero images, demonstrating how technical implementation errors can undermine intended performance gains.

The broader implications extend beyond individual retailer performance to encompass competitive positioning and market share dynamics. Consumers conducting research and price comparisons during Deliberate and Deal-Seeking phases of holiday shopping frequently abandon slow-loading sites in favor of faster competitors. Research shows 60% of consumers abandon online purchases due to user experience issues, creating direct linkage between technical performance and revenue outcomes.

Platform developments have introduced new performance optimization tools. Cloudflare’s Speed Brain technologylaunched in September 2024, utilizing Speculation Rules API to prefetch content for likely next navigations. Initial testing demonstrated up to 75% reduction in loading times with aggressive models, while conservative implementations on Cloudflare-enabled domains achieved 45% Largest Contentful Paint reductions at the 75th percentile. Free websites experienced savings of 0.88 to 1.1 seconds on successful prefetches.

The performance challenges documented in the report occur against backdrop of sustained consumer spending growth. October retail sales increased 0.6% month-over-month and 5% year-over-year, demonstrating consumer readiness for holiday purchases despite economic uncertainty. Total retail sales for the first 11 months of 2025 increased 5.06% year-over-year, while core sales expanded 5.22% during the same period.

The retail media implications of performance gaps carry particular significance as the sector expands toward projected global advertising revenue exceeding $300 billion by 2030. Real-time transaction data provides merchants and advertisers with visibility into consumer behavior patterns, but poor website performance undermines conversion regardless of advertising effectiveness. The concentration of consumer spending during holiday periods makes fourth-quarter technical performance critical for retailers balancing inventory availability with marketing investment.

Google’s search infrastructure changes have increased focus on performance metrics. Google removed the Page Experience report from Search Console in November 2024, consolidating performance monitoring into individual Core Web Vitals and HTTPS reports. The Core Web Vitals report continues measuring Largest Contentful Paint with threshold of 2.5 seconds for good performance, Interaction to Next Paint evaluating responsiveness with 200-millisecond threshold, and Cumulative Layout Shift tracking visual stability with target score of 0.1 or less.

The documented performance failures raise questions about retailer technical investment priorities and execution capabilities. Despite widespread awareness of mobile shopping dominance and Core Web Vitals importance for both user experience and search rankings, majority performance across analyzed sectors falls short of established thresholds. The gap between technical knowledge and implementation suggests systematic challenges in website development, hosting infrastructure capacity, or resource allocation decisions.

Industry observers note that performance testing under laboratory conditions often produces different results than real-world user experiences during traffic spikes. The October 2025 analysis timing captured baseline performance levels but may not fully represent behavior during actual peak shopping events when server loads, database queries, and content delivery networks face maximum stress. Historical evidence shows major website crashes occurring during Black Friday despite advance preparation.

The report concluded that retailers maintain substantial opportunity for improvement ahead of remaining holiday shopping periods. “Even small gains in page speed and accessibility can significantly boost conversion rates and customer satisfaction, especially as mobile continues to dominate online shopping,” according to Lloyd Cobb. “Optimizing images, reducing unnecessary plug-ins, testing mobile performance, and choosing reliable hosting can all help prevent downtime and keep sites running efficiently when traffic spikes.”

The analysis did not provide longitudinal data comparing 2025 performance against previous years, limiting ability to assess whether retail sector technical capabilities have improved or deteriorated over time. Similarly, the study did not correlate performance metrics with actual sales outcomes or conversion rates for specific retailers, making it difficult to quantify the precise revenue impact of documented performance gaps. The weighted index methodology aggregated multiple metrics into sector scores but did not publish individual retailer performance data.

Generation Z attention span patterns, combined with mobile device dominance and high cart abandonment rates, create a business environment where technical performance directly influences commercial outcomes. The documented gap between current retail website capabilities and established performance thresholds suggests many retailers risk losing substantial revenue to competitors who invest more effectively in technical infrastructure. The compressed timeline between Cyber Week and Christmas in 2025, combined with early shopping behavior driven by tariff concerns, intensifies the commercial consequences of performance failures during remaining holiday shopping weeks.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- October 2025: 20i researchers analyzed over 350 largest U.S. online retailers using Google’s PageSpeed Insights tool

- October 16, 2025: National Retail Federation announced consumers plan to spend $890.49 per person on holiday items

- October 27-28, 2025: Wunderkind survey revealed 34% of consumers began holiday shopping in October with 71% citing tariff concerns

- November 7, 2025: National Retail Federation released Global Port Tracker projecting November-December import volume slowdown

- November 8, 2025: SEO agency reported 20% traffic decline after lazy loading implementation despite PageSpeed improvements

- November 10, 2025: Retail sales grew 5% in October as consumers prepared for holidays

- November 12, 2025: 20i published full US Site Speed Report analyzing retail sector performance

- November 21, 2025: TransUnion released Q4 2025 Consumer Pulse study showing younger consumers driving holiday optimism

- November 28, 2025: Black Friday represented year’s largest promotional sales event

- December 1, 2025: Cyber Monday followed as second major holiday shopping date

- December 9, 2025: Press release distributed warning two-thirds of websites too slow for consumers on mobile

- December 12, 2025: November retail sales data showed 4.53% year-over-year increase

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Hosting provider 20i published the US Site Speed Report analyzing over 350 of the largest online retail sites across 12 sectors in the United States. Director Lloyd Cobb provided analysis of the findings and recommendations for retailers. The study examined health and wellness, finance, fitness, pets, fashion, gaming, home, electronics, streaming, beauty, travel, and retail sectors.

What: The analysis found 65% of major U.S. retail websites fail Core Web Vitals assessments on mobile devices, compared with 53% failing on desktop. Overall, 58.2% of analyzed brands failed to meet Google’s performance thresholds across both platforms. Average accessibility scores reached 87 out of 100, below the recommended 89 threshold. Health and wellness retailers performed best with 55% pass rate, while retail and wholesale performed worst with 76% failing assessments.

When: Researchers conducted the analysis in October 2025 using data correct as of that month, positioning the study to capture retailer preparation ahead of Thanksgiving, Black Friday, and Christmas shopping periods. The press release was distributed December 9, 2025, during the peak holiday shopping season. The full report was published November 12, 2025 on the 20i blog.

Where: The study focused exclusively on United States retail websites across 350 of the largest online retailers in various product categories. Researchers used Google’s PageSpeed Insights tool to analyze Core Web Vitals data measuring page speed and accessibility. Performance failures occurred across mobile and desktop platforms, with mobile showing significantly worse results. Over half of American internet browsing occurs via mobile at 57%.

Why: The research aimed to identify which U.S. retail sectors face greatest risk of losing revenue during peak holiday shopping season due to poor website performance. Slow mobile performance poses direct threat to conversion and revenue as consumers abandon purchases due to user experience issues. Research shows 70% of online shopping carts were abandoned in 2024, with 17% attributed to website crashes. Younger generations have attention spans averaging eight seconds for Generation Z, intensifying impact of slow-loading pages. The findings matter for marketing community as poor technical performance undermines advertising effectiveness and directly reduces conversion rates regardless of campaign quality.