Dublin, Jan. 22, 2026 (GLOBE NEWSWIRE) — The “Austria B2C Ecommerce Market Size & Forecast by Value and Volume Across 80+ KPIs – Databook Q4 2025 Update” report has been added to ResearchAndMarkets.com’s offering.

The ecommerce market in Austria is expected to grow by 6.6% annually, reaching US$19.22 billion by 2025.

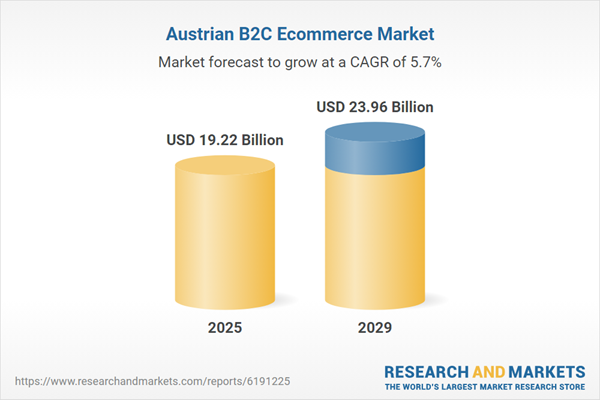

The ecommerce market in the country has experienced robust growth during 2020-2024, achieving a CAGR of 9.5%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 5.7% from 2025 to 2029. By the end of 2029, the ecommerce market is projected to expand from its 2024 value of US$18.02 billion to approximately US$23.96 billion.

Over the next 2-4 years, Austria’s online retail market is expected to grow steadily rather than explosively, with projected compound annual growth rates in the mid-single digits (5.8-6.6 %). Key focal areas will include mobile-first experiences and checkout optimisation, the broader use of alternative delivery formats (parcel lockers, pickup points), and sustainability-driven initiatives (re-commerce, packaging reduction), which will influence merchant investments. Nevertheless, the dominance of large foreign marketplaces is unlikely to abate significantly, meaning Austrian domestic retailers will face continued margin and traffic pressure unless they differentiate via service, localisation or niche positioning.

Current State of the Market

- The Austrian B2C e-commerce sector is operating in a mature yet moderately growing phase, with online retail sales of approximately €10.6 billion in 2024 and an online retail share of about 15.5 % of total consumer retail spend. Internet penetration is high (around 95% of the population), and some 6 million Austrians shopped online in 2023, indicating near saturation of basic digital consumer access.

- Cross-border platforms continue to dominate: more than half of Austrian online expenditure flows to foreign online stores, underscoring the competitive pressure on domestic players. In terms of product categories, the largest online segments by revenue in 2024 were clothing (~€2.4 billion), consumer electronics (~€1.3 billion) and furniture (~€0.9 billion) – while categories such as toys (35 %), sporting goods (34 %) and clothing (30 %) show the highest online penetration relative to total retail.

Key Players and New Entrants

- Major international and regional players anchor the competitive landscape in Austria. Amazon (via its German operations) is consistently ranked as the highest-traffic online retailer in Austria. Other significant players include Zalando (fashion) and local generalist platforms such as Universal at and Eduscho. As for new entrants, Asian platforms such as Temu and Shein have begun making inroads into the Austrian market, especially among younger consumers.

- Domestic service-ecosystem providers are also gaining relevance: Austrian fulfilment and payment-service firms support local merchants in adapting to cross-border competition and mobile-first behaviours. For example, Austrian specialist e-commerce agencies appear among the top “E-commerce & Shopping” companies by traffic and services.

Recent Launches, Mergers, and Acquisitions

- While publicly reported pure-play Austrian e-commerce acquisitions are limited in major consumer-facing segments, the broader Austrian M&A environment in 2025 recorded a record-high transaction volume (~€17.3 billion in H1), albeit many deals were outside retail.

- In the e-commerce domain, what is visible is a stronger partnership or platform integration: marketplaces such as Amazon have expanded logistics centres in Austria (four logistics hubs plus an R&D office) to support their operations. On the domestic side, support infrastructure (fulfilment, logistics tech, payment services) is seeing new roll-outs and some consolidation among service providers. However, these tend to be privately held and not always publicly disclosed.

- Regulatory attention is increasing: Austrian policy-making and retail-industry advocacy groups are actively calling for stricter enforcement of cross-border competition rules and product-safety compliance to level the playing field for domestic online merchants.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 110 |

| Forecast Period | 2025 – 2029 |

| Estimated Market Value (USD) in 2025 | $19.22 Billion |

| Forecasted Market Value (USD) by 2029 | $23.96 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Austria |

Report Scope

Austria B2C Ecommerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Austria Social Commerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Austria Quick Commerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Austria B2C Ecommerce Market Segmentation by Ecommerce Vertical

- Retail Shopping

- Travel & Hospitality

- Online Food Service

- Media & Entertainment

- Healthcare & Wellness

- Technology Products & Services

- Other

Austria B2C Ecommerce Market Segmentation by Retail Shopping Category

- Clothing, Footwear & Accessories

- Health, Beauty & Personal Care

- Food & Beverage

- Appliances & Electronics

- Home Improvement

- Books, Music & Video

- Toys & Hobby

- Auto Parts & Accessories

- Other

Austria B2C Ecommerce Market Segmentation by Retail Shopping Sales Channel

- Platform-to-Consumer

- Direct-to-Consumer

- Consumer-to-Consumer

Austria B2C Ecommerce Market Segmentation by Travel & Hospitality Category

- Air Travel

- Train & Bus

- Taxi & Ride-Hailing

- Hotels & Resorts

- Other

Austria B2C Ecommerce Market Segmentation by Travel and Hospitality Sales Channel

- Air Travel- Aggregator App

- Air Travel- Direct-to-Consumer

- Train & Bus- Aggregator App

- Train & Bus- Direct-to-Consumer

- Taxi & Ride-Hailing- Aggregator App

- Taxi & Ride-Hailing- Direct-to-Consumer

- Hotels & Resorts- Aggregator App

- Hotels & Resorts- Direct-to-Consumer

- Other- Aggregator App

- Other- Direct-to-Consumer

Austria B2C Ecommerce Market Segmentation by Online Food Service Sales Channel

- Aggregator App

- Direct-to-Consumer

Austria B2C Ecommerce Market Segmentation by Media & Entertainment Sales Channel

- Streaming Services

- Movies & Events

- Theme Parks & Gaming

- Other

Austria B2C Ecommerce Market Segmentation by Engagement Model

- Website-Based

- Live Streaming

Austria B2C Ecommerce Market Segmentation by Location

Austria B2C Ecommerce Market Segmentation by Device

Austria B2C Ecommerce Market Segmentation by Operating System

- iOS / macOS

- Android

- Other Operating Systems

Austria B2C Ecommerce Market Segmentation by City Tier

Austria B2C Ecommerce Market Segmentation by Payment Instrument

- Credit Card

- Debit Card

- Bank Transfer

- Prepaid Card

- Digital & Mobile Wallet

- Other Digital Payment

- Cash

Austria B2C Ecommerce Consumer Demographics & Behaviour

- Market Share by Age Group

- Market Share by Income Level

- Market Share by Gender

Austria B2C Ecommerce User Statistics & Ratios

- Internet Users

- Ecommerce Users

- Social Media Users

- Smartphone Penetration

- Banked Population

- Ecommerce Per Capita

- GDP Per Capita

- Ecommerce as % of GDP

- Cart Abandonment Rate

- Product Retun Rate

Austria B2C Ecommerce Operational Metrics by Ecommerce Segment

- Gross Merchandise Value by Segment

Austria B2C Ecommerce Operational Metrics by Retail Shopping Category

- Gross Merchandise Value by Category

Austria B2C Ecommerce Operational Metrics by Sales Channel

- Gross Merchandise Value by Channel

Austria B2C Ecommerce Operational Metrics by Location

- Gross Merchandise Value by Location

Austria B2C Ecommerce Operational Metrics by Device

- Gross Merchandise Value by Device

Austria B2C Ecommerce Operational Metrics by Operating System

- Gross Merchandise Value by Operating System

Austria B2C Ecommerce Operational Metrics by City Tier

- Gross Merchandise Value by City Tier

Austria B2C Ecommerce Operational Metrics by Payment Instrument

- Gross Merchandise Value by Payment Instrument

For more information about this report visit https://www.researchandmarkets.com/r/394rmv

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.