Headless Commerce has moved from a “developer-forward” concept to a boardroom-level growth lever, and many Online Retailers are now treating it as the default architecture for modern Ecommerce. The reason is simple: shoppers don’t experience channels the way organizations are structured. A customer might discover a product in a short video, compare reviews on mobile, complete checkout on desktop, and pick up in store—expecting inventory, pricing, and content to match perfectly each time. When legacy stacks can’t keep up, brands lose trust, sales, and momentum. In 2026, the retailers gaining share are the ones building faster storefronts, running more experiments, and shipping improvements weekly—without breaking core operations.

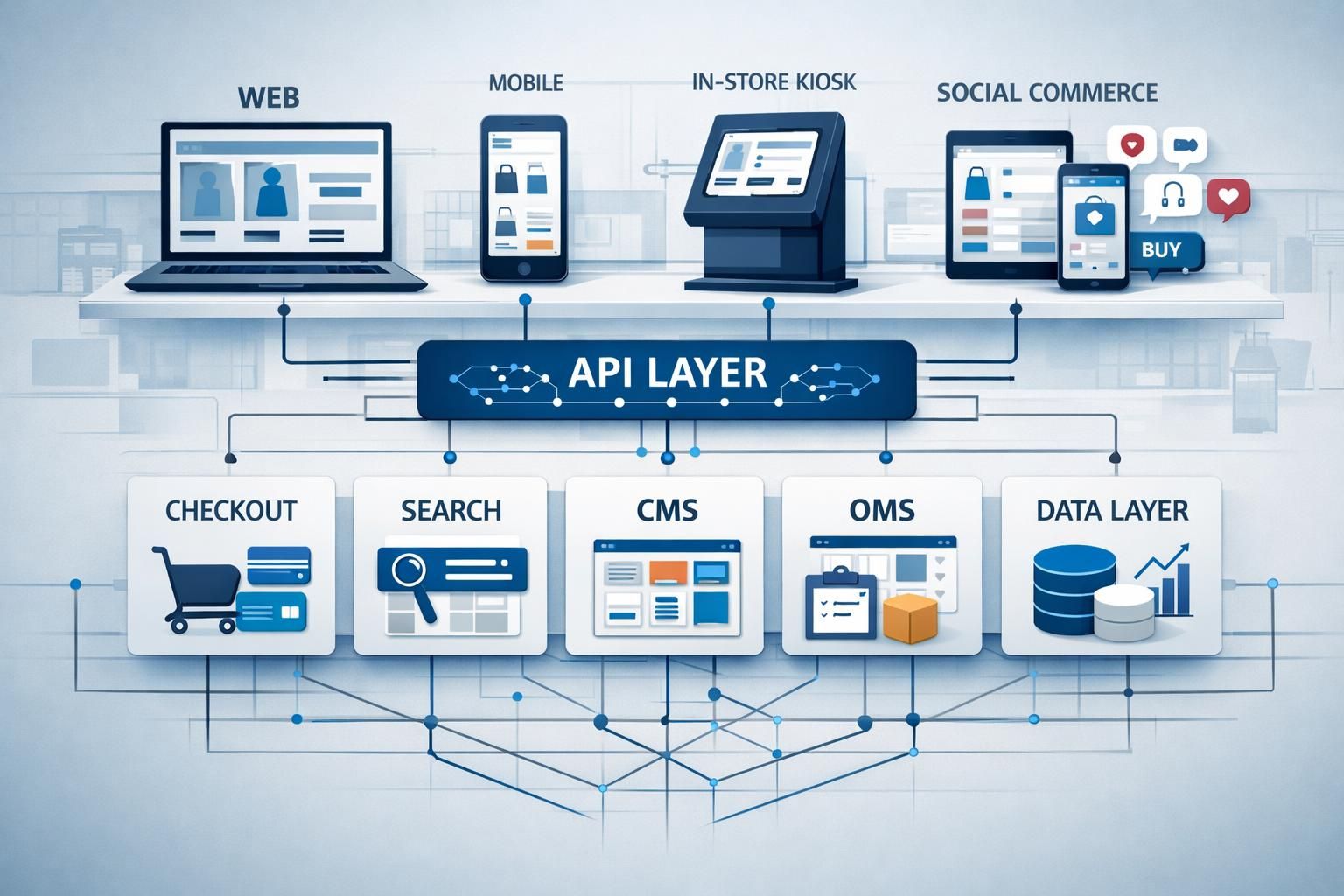

What’s changing isn’t just the “front end.” Retail Technology is being reassembled into modular services—search, checkout, promotions, content, loyalty—connected through an API-First approach so teams can iterate without waiting for a monolithic upgrade cycle. This shift also aligns with the rise of AI as the operational layer of commerce, turning personalization, merchandising, and service into real-time systems. The result is a different kind of Digital Transformation: less about ripping and replacing everything, and more about orchestrating a resilient, Omnichannel foundation that keeps Customer Experience consistent while accelerating innovation.

- Market momentum: headless commerce is scaling rapidly, following a multi-year growth curve that has pushed enterprise adoption to roughly two-thirds in many benchmarks.

- Composable becomes normal: modular, API-driven stacks are now common among major brands, enabling independent releases and scaling per capability.

- Speed is revenue: even a 1-second performance improvement can lift conversions, while slow pages measurably depress purchase rates.

- AI is the commerce layer: personalization and dynamic merchandising increasingly shape revenue, with leaders seeing outsized gains in conversion and order value.

- Unified data wins Omnichannel: synced identity, inventory, and pricing make ROPO and BOPIS journeys feel effortless.

- Search is a profit center: real-time discovery and natural language queries reduce abandonment and guide customers to higher-intent paths.

- Operations modernize too: smart OMS and fulfillment automation turn post-purchase into a differentiator, not a cost sink.

Why Headless Commerce Adoption Is Rising Among Online Retailers in 2026

In 2026, the story behind Headless Commerce adoption is less about hype and more about survival math. Many retail executives have learned—sometimes painfully—that monolithic Commerce Platforms age like concrete: stable until the moment you need to change something fast. A pricing experiment takes weeks because it’s coupled to a theme. A new market launch stalls because translations and localized content are embedded in templates. Meanwhile, customers keep moving, and their expectations keep climbing.

Consider a fictional but familiar brand: “Northwind Outfitters,” a mid-market apparel retailer that started as web-only and then expanded to pop-ups and partner stores. Northwind’s marketing team wants the same product story to appear on Instagram shopping, the website, email, and in-store screens. The operations team needs accurate availability for “check stock near me.” The old platform can do some of that, but every new channel becomes a special project. Headless flips the model by decoupling the experience layer from back-office logic so each touchpoint can evolve without rewriting the whole system.

The economics are also persuasive. Industry reporting has pegged the headless software market at around $1.6B in the early 2020s, expanding at roughly 22%+ annually into the decade; other projections place it near $1.74B in 2025 with a CAGR around 23.7%. Those numbers matter because they signal vendor maturity: more implementation partners, better tooling, and patterns that reduce risk. Enterprise adoption has also become mainstream, with many studies clustering around 64% usage for large organizations—an important indicator that the architecture is no longer “experimental.”

Customer expectations are the bigger force. Multi-channel buyers tend to be worth more over time; some benchmarks suggest a 30% higher lifetime value when shoppers engage across channels. That’s an Omnichannel argument, but it’s also an organizational argument: data and delivery systems must be designed for the way people shop, not for how departments are separated.

Performance remains a relentless driver. A 1-second delay has been associated with conversion drops around 7% in many retail performance discussions. When teams move to headless frontends, it’s not unusual to see speed gains so large they reshape merchandising outcomes—some implementations cite up to 80% speed improvement versus legacy approaches, along with meaningful reductions in bounce rate. If your product pages feel instant, you don’t just win SEO and paid media efficiency; you also earn the right to personalize more aggressively without slowing down.

Retailers also look at productivity. After decoupling, many IT teams report reclaiming significant maintenance time—figures like 40 hours per week show up repeatedly in benchmarking—because upgrades, patches, and content changes don’t require the same cross-system choreography. That time can go into customer-facing improvements: better navigation, faster checkout, and testing new experiences.

For teams trying to quantify customer behavior changes before committing engineering resources, instrumentation matters. Some organizations start with experience analytics—heatmaps and recordings—to identify friction points and prioritize the first headless migration slice, using guidance like heatmap and session recording tactics to build a business case rooted in observed shopper behavior.

The next step is understanding what “headless” becomes in practice: not a single product, but a composable, API-First model where each capability can be chosen and improved on its own—an angle that leads directly to the composable stack discussion.

Composable and API-First Commerce Platforms Reshaping Ecommerce Tech Stacks

Composable commerce is the practical expression of Headless Commerce: the architecture you get when you treat commerce capabilities as interchangeable services rather than a single all-in-one suite. In 2026, this approach is increasingly the norm for competitive Ecommerce teams because it matches how retail organizations actually work. Merchandisers want better bundling and promotions. Marketers want content velocity. Engineers want safe deployments. Finance wants predictable total cost. A composable stack lets each group improve “their” part without creating a system-wide bottleneck.

The language around composability is often summarized by MACH principles—microservices, API-first, cloud-native, and headless. In the U.S. market especially, modular adoption has become widespread; some data points suggest that over 90% of brands have implemented elements of modular, API-driven systems, with further adoption planned. At the same time, forecasts indicating 60%+ adoption among mid-sized and large retailers by 2027 reflect a clear direction: composability is moving from optional to expected.

Northwind Outfitters (our hypothetical retailer) takes a phased approach. They don’t “rebuild everything.” They start by replacing the storefront layer with a headless frontend, while keeping the existing backend for orders. Then they swap search for a best-of-breed service. Later, they modernize checkout. This staged path reduces business risk and trains the organization to operate in a product mindset.

What Online Retailers actually gain from composability

The promise is not abstract flexibility; it’s operational leverage. With independent services, you can scale only what’s under pressure. If search traffic spikes during a campaign, you scale search without scaling the entire platform. If checkout is the conversion chokepoint, you optimize it without rewriting catalog management. That’s how API-First design turns into measurable performance and resilience.

- Independent scaling: allocate resources to the bottleneck service rather than over-provisioning everything.

- Faster experimentation: teams can release features more frequently—often cited as up to 5x compared with monolith release cycles.

- Reduced lock-in: swapping components is feasible when contracts or capabilities no longer fit.

- Lower long-term cost curves: several studies estimate up to 30% lower TCO across five years when decoupling reduces maintenance drag.

Composable stacks do introduce new management challenges. Vendor sprawl is real, and many organizations note the complexity of coordinating multiple providers. The winning pattern is governance: clear API standards, shared observability, and a small “platform team” that owns experience consistency.

Examples of composable Commerce Platforms in real deployments

Enterprises often choose a platform like commercetools for complex multi-brand or B2B scenarios, where granular control and extensibility matter. Shopify Plus is frequently selected by brands that value speed-to-market and a massive ecosystem of integrations, while still seeking headless capabilities. Saleor appeals to teams that prioritize developer experience and GraphQL-friendly patterns. The key isn’t which name you pick; it’s whether the platform can participate cleanly in your architecture through well-modeled APIs.

For B2B-focused retailers tracking how newer offerings evolve, updates in specialized platforms can influence roadmap decisions; monitoring industry changes like the Cloudfy B2B commerce update can help teams understand how vendor capabilities are expanding around catalog complexity, account pricing, and procurement workflows.

Once the stack is modular, content becomes the next constraint. A composable system still fails if product storytelling can’t move at the speed of channels—so the conversation naturally turns to headless CMS and Omnichannel publishing.

Retail teams often learn composability faster by watching implementation breakdowns and architecture reviews.

Headless CMS and Omnichannel Customer Experience Storytelling at Scale

Retail is no longer “selling products online”; it’s publishing experiences everywhere. In 2026, a headless CMS is less a marketing tool and more a central nervous system for Customer Experience across Omnichannel touchpoints. The premise is straightforward: content should be created once, stored as structured data, and delivered by APIs to any interface—web, mobile, email, social storefronts, kiosks, even emerging surfaces like voice assistants.

For Northwind Outfitters, the pain point wasn’t the lack of content—it was duplication and inconsistency. Their product description differed slightly across the mobile app and the website because two teams edited two systems. Their return policy banner was updated on the homepage but not on checkout. Shoppers noticed. One benchmark often cited is that 67% of customers check return policies before buying; inconsistent information is not a cosmetic problem, it’s conversion leakage.

Headless CMS addresses this by making content modular. A “shipping promise” block can be reused across product pages, cart, order confirmation, and customer service screens. A “winter campaign” story can render differently on mobile than on desktop while drawing from the same structured fields. That architecture supports speed too: many organizations report headless systems simplify consistent multi-channel delivery—figures around 82% show up frequently—because changes propagate everywhere automatically.

Why content agility has become a retail KPI

Marketing calendars move faster than platform release cycles. Promotions, creator collaborations, and social moments can peak and fade in days. When content systems are coupled to presentation, teams either slow down or ship inconsistencies. With a headless CMS, marketers can update content without waiting for a frontend release, as long as the content model is well-designed and guardrails exist.

There’s also a global dimension. Localization is not just translation; it’s imagery, regulatory copy, sizing charts, currency display, and cultural nuance. Some headless benchmarks point to 50% faster deployment of localized content, which directly supports cross-border conversion. Currency and payment flexibility matter too: many shoppers expect multiple payment options, and API-driven experiences make adding them much easier than reworking a monolith.

Common headless CMS choices and how they fit Retail Technology teams

Strapi is often chosen when teams want maximum customization and control, especially with internal developers who can tailor workflows. Storyblok is popular when visual editing and component-based page assembly are priorities, letting non-technical users move quickly without losing structure. Sanity tends to shine in real-time collaboration environments and complex content modeling. The “right” CMS is the one that matches governance and content operations maturity; it’s notable that only a minority of organizations feel their content strategy is fully mature, so some retailers invest in content modeling workshops before migrating.

Large-scale case studies illustrate the potential. Global restaurant and retail brands have centralized content for tens of thousands of locations through a single headless system, while still enabling local variations. Northwind applies a similar pattern: a global content library for product education, plus regional overlays for climate-specific merchandising and local policies.

When content becomes structured and API-delivered, it can also be personalized and tested more effectively. Headless architectures commonly enable full-journey A/B tests faster than traditional stacks. That sets up the next acceleration point: AI-driven personalization that adapts experiences in real time rather than relying on static segments.

AI-Driven Personalization and Real-Time Search Trends Powering Conversion

AI is increasingly treated as the operating layer of modern Ecommerce, and headless architectures make it easier to plug AI capabilities into every step of the journey. In 2026, personalization is no longer limited to “recommended products.” It shapes landing pages, category sorting, on-site messages, bundles, and even the tone of content blocks—while remaining consistent across Omnichannel surfaces.

The financial case is hard to ignore. Multiple industry analyses link comprehensive personalization to outsized revenue impact, with figures such as 40% more revenue from personalization-led activities appearing in leadership benchmarks. Product recommendations alone can represent a significant share of online revenue in many categories. At the same time, shoppers clearly reward relevance: around 80% of consumers report being more likely to purchase when offered a personalized experience, and many will spend beyond their initial plan when experiences feel tailored.

What AI personalization looks like in Headless Commerce

In a decoupled stack, AI services can act across multiple layers via APIs: a recommendation engine returns ranked SKUs; the CMS returns personalized editorial blocks; the pricing service applies rule-based or AI-assisted adjustments; the search engine boosts results based on intent. The result is a storefront that behaves more like a conversation than a catalog.

Northwind begins with dynamic product detail pages. Returning customers see the most relevant fit guidance and a personalized “complete the look” section based on prior browsing and returns. New shoppers get educational content and social proof. Over time, they add “smart bundles” that identify complementary items beyond obvious pairings—an approach that can lift average order values meaningfully when executed with guardrails.

Real-time search and discovery as a conversion engine

Search has quietly become one of the highest leverage parts of retail UX. When customers use search, they often have intent—and intent converts. Modern headless-friendly search services deliver millisecond responses, typo tolerance, and personalization. Some platforms regularly achieve sub-20ms responses under typical conditions, which matters because speed is perceived quality.

The stakes are high: poor search experiences contribute to massive lost revenue across retail, and a large share of shoppers abandon when results are irrelevant. Natural language search is changing behavior too. Instead of typing “shoes,” customers ask for “running shoes under $100 for flat feet,” expecting the engine to understand price, attributes, and constraints. Implementations of natural language search have been linked to conversion lifts (often cited around the mid-20% range) because customers can express intent precisely.

|

Capability |

What It Enables in an API-First Stack |

Why It Matters for Customer Experience |

Representative Metric (Industry Benchmarks) |

|---|---|---|---|

|

Real-time personalization |

Behavior-based content and product ranking via APIs |

More relevant journeys across web, app, and email |

Up to 40% more revenue tied to personalization programs |

|

Recommendation-driven merchandising |

Dynamic bundles, related items, next-best offers |

Higher AOV without “pushy” upsells |

Personalized sessions can dramatically lift order value in leaders |

|

Modern search & discovery |

Intent interpretation, typo tolerance, ranking rules |

Fewer dead ends; faster product finding |

Sub-20ms response targets are common in top tools |

|

Performance optimization |

Edge caching, SSR/SSG strategies, image optimization |

Faster pages, better SEO, less bounce |

1-second improvement can lift conversions by ~2% (and delays can depress more) |

AI also depends on data quality. If customer identity is fragmented, personalization becomes creepy or wrong. If inventory isn’t accurate, recommendations frustrate. That’s why the AI and search layer inevitably pushes organizations toward a unified data foundation and stronger operational orchestration.

Teams often explore AI merchandising, on-site search tuning, and personalization playbooks through practical demos and teardown videos.

Unified Data Layer, Smart OMS, and Edge Performance for Omnichannel Growth

Omnichannel success is rarely blocked by ideas; it’s blocked by mismatched data and operational gaps. In 2026, retailers investing in Headless Commerce increasingly pair it with a unified data layer and a modern order management approach, because the most valuable experiences—ROPO, BOPIS, BORIS—collapse if inventory, pricing, and identity disagree across systems.

A unified data layer acts as a standard interface over messy realities: ERP records, PIM data, warehouse feeds, store stock counts, loyalty profiles, and marketing events. The goal is a single source of truth that every channel can trust. This is not a “big bang” rebuild; it’s typically orchestration: connecting and cleaning data, resolving identities, and exposing consistent API models to frontends and services.

Identity, inventory, and pricing: the three data pillars that make or break trust

Inventory accuracy is the most visible. Customers don’t forgive “available” items that disappear at checkout or during pickup. For BOPIS especially, the operational requirement is real-time availability. The growth of buy-online-pickup behaviors—accelerated earlier in the decade—proved how quickly customers adopt convenience when it works, and how quickly they abandon it when it fails.

Pricing consistency is equally crucial. If a shopper sees one price in the app and another in-store, the experience feels dishonest even when the discrepancy is accidental. Unified pricing data helps teams spot and correct drift, and supports clear promotional rules across channels.

Identity resolution is the quiet power behind personalization and service. Many brands now consider first-party data their most valuable personalization asset; some tracking shows that sentiment rising sharply from earlier years. With stronger identity stitching, service agents can see a single customer narrative: what was browsed, what was purchased, what was returned, and what is currently in a pickup queue.

Smart OMS and fulfillment automation as a competitive differentiator

Once data is unified, execution must follow. A smart OMS orchestrates routing, availability, and fulfillment choices across warehouses and stores. In a headless stack, OMS capabilities become services: “available-to-promise,” “ship-from-store eligibility,” “split shipment rules,” “return to store authorization.” This operational layer protects Customer Experience by ensuring the brand only promises what it can deliver.

Customer expectations are unforgiving: a majority of shoppers want fast shipping and consider delivery speed in purchase decisions. Automation is how retailers keep up without exploding cost. Some operations report shrinking order processing from days to hours and reducing costs by 10–15% when automation and better routing logic are implemented thoughtfully.

Edge performance and DevOps: the infrastructure that keeps experiences consistent worldwide

Modern Retail Technology is global by default. Performance gaps across regions can quietly destroy conversion rates: a site that loads instantly in one city may crawl in another if it relies on centralized servers. Edge computing moves critical work closer to users, improving Core Web Vitals and perceived responsiveness. Performance improvements correlate tightly with outcomes: conversion lifts are often observed with each second saved, while slow experiences trigger abandonment—especially on mobile.

DevOps practices complete the picture by making changes safe and frequent. Organizations running headless setups commonly deploy updates far more often than monolith users, reducing time-to-market while keeping uptime high during peaks. For Northwind, this means shipping localization fixes, payment additions, and checkout experiments continuously—without waiting for quarterly releases.

What emerges is a practical blueprint: unify data, orchestrate orders, and deliver experiences at the edge. That combination turns “headless” from an architecture diagram into measurable growth across Omnichannel touchpoints—an insight that helps executives frame Headless Commerce adoption as a business operating model, not a technology swap.