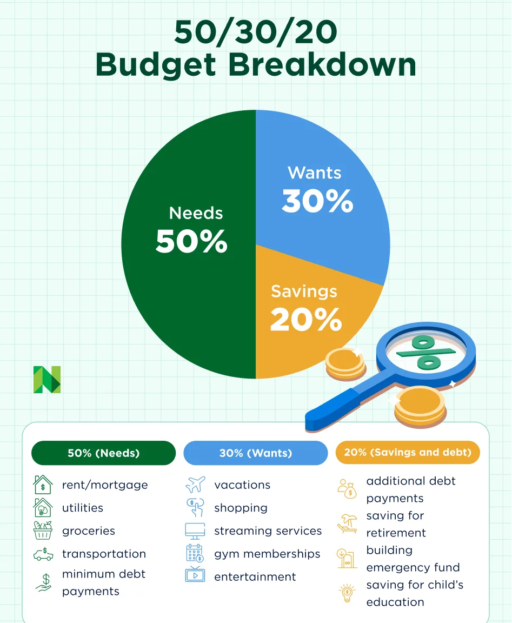

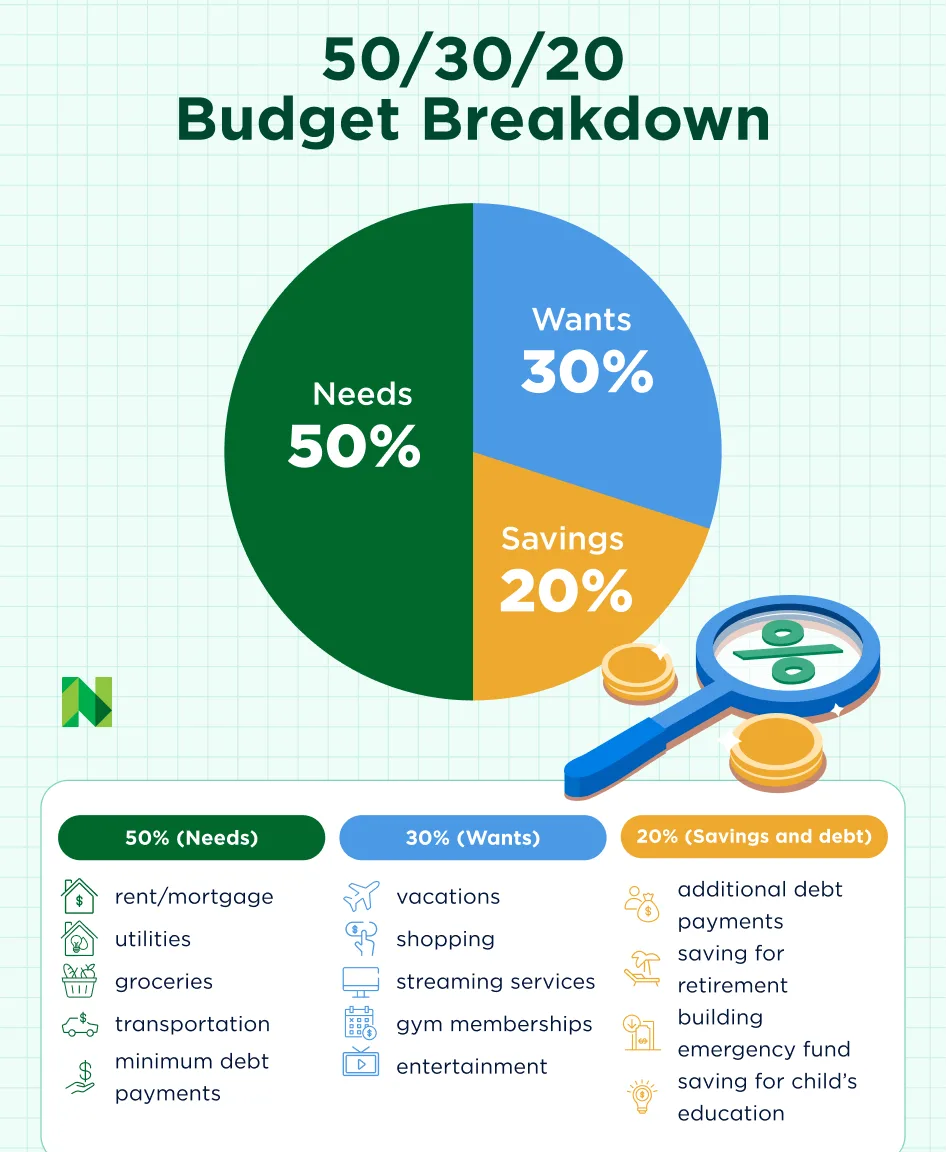

Creating a budget can feel overwhelming — until you have a simple tool that shows you exactly where your money should go. A good budget planner helps you understand your spending, cover your essentials and still make progress on savings or debt.

Add your monthly income, expenses and any contributions to savings or debt repayment in the downloadable worksheet — or, complete our online budget planner. We’ll total up your needs, wants and savings and debt and compare it with the 50/30/20 breakdown so you can make adjustments if needed.

Information to gather before you build your budget

Before using the free budget spreadsheet, collect a few key pieces of financial information:

✅ Take-home pay: Your monthly income after taxes. A recent pay stub will likely be the easiest place to find this information.

✅ Fixed expenses. Costs that stay the same each month, like rent, insurance, loan payments, child care and memberships. Check account statements to find recurring charges and their amounts.

✅ Variable costs. Costs that change month to month, including utilities like electricity and water, groceries, fuel costs, shopping, dining out, travel and entertainment. Look back at past transactions to estimate your spending in these categories.

✅ Debts, including interest. Include all debts and interest — credit cards, medical bills, student loans and more.

Having these details ready will make creating your budget quicker and more accurate.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.