Ensemble, one of the country’s oldest multi-designer stores, explored social impact issues in teaming with “The Baradari” project as part of an online campaign to raise funds for the country’s crippled crafts industry. The initiative caught the attention of online shoppers, leading to increased cart sales on the company’s website.

Some have hired experts to train internal teams on social media and other virtual tools, and to help improve their online customer service, including how to address demands and queries. In a few cases, they’ve even had to educate consumers with little if any experience on online shopping fundamentals.

Designer Masaba Gupta uses its in-house stylists to create educational fashion content. Monica Shah, one half of couture label Jade, employs video “as a tool for engagement with online audiences, which include Q&A sessions to help make the design process or selection of a lehenga online easier”.

Discounting, a tried and true method, has worked to woo price-sensitive shoppers concerned about the state of the global economy. GDP in India, the world’s fifth largest economy, fell nearly 20 per cent in the quarter ending 30 June.

Following a 20 per cent discount, Bodice’s pared-back neutrals and flowing lounge pants became the brand’s bestselling items. Ruchika Sachdeva, Bodice creative director and International Woolmark Prize winner, said the items’ popularity helped the company navigate a difficult time by incentivising shoppers and “generating some revenue and sustaining the business during these times”.

Even some luxury and couture companies, which have historically avoided such measures, have resorted to markdowns. “Times have changed from when online shopping was limited to lower-value items — people are now willing to shop for high-value products since travel is restricted,” says Tahiliani. “However, this is not without the caveat of additional engagement from the brand to close sales.”

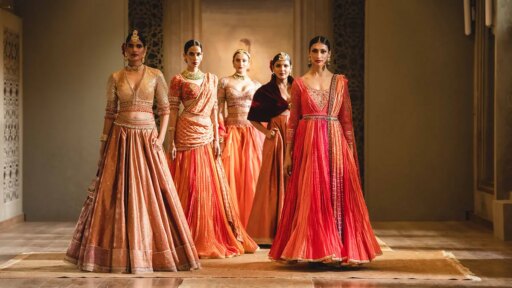

Mishra has noticed growing demand for lehengas, saris, gowns and statement dresses, in India and abroad. “Consumers are choosing to invest in clothes based on an inevitable need, such as an important upcoming occasion or a festivity”, he says, adding that many of these higher-end items have emphasised comfort, craft and versatility to an unprecedented degree, along with affordability.

His recent collection, Butterfly People, which aired at Paris Digital Haute Couture Week A/W 2020/21, racked up orders for its intricate masks and craft-heavy dresses. “In the luxury category, couture seems to have more demand than ready-to-wear,” he says. “Furthermore, classics and artisanal pieces are standing out while the avant-garde and experimental silhouettes are being preferred less at the moment.”

Moving into an active holiday season in India, with Navaratri, Diwali and Christmas coming up, some brands are counting on gift-giving to increase sales. “It’s that time of year when people communicate their sentiments via gifting,” says Palak Shah, Ekaya’s CEO. The hope is that the summer’s investments in digital shopping capabilities will carry the season. “We’re already finding people making queries about gifts like handwoven scarves and pocket squares, regardless of festive or auspicious occasions.”

To receive the Vogue Business newsletter, sign up here.

Comments, questions or feedback? Email us at feedback@voguebusiness.com.

What will happen to India’s luxury wedding industry after lockdown?

Why India’s Reliance is adopting WhatsApp

In India, fashion retailers focus on e-commerce for post-pandemic sales