The Gist

- Google pressured on transparency. Regulators in the US force Google to share search data and AI insights with competitors.

- AI rivals gain ground. Google’s market share dipped below 90% as ChatGPT Search, Perplexity and others capture attention.

- Marketers face new playbook. Traditional SEO strategies may need overhauls as AI search changes ranking factors and engagement patterns.

Google, the near-90% market share owner of finding things on the internet, will have to spill the search beans as part of a federal judge’s historic ruling in a 5-year-old antitrust case against the search giant. And that includes all the AI search beans, too. AI Overviews, here we come.

What does this mean for marketers already grappling with a lightning-fast changing search landscape because of generative engine optimization’s arrival thanks to large language models crawling the web for content?

Not anything crazy — yet.

“In the short term, this ruling won’t drastically affect the SEO rankings since click-through-rate dynamics apply across the board,” said Bradley Keys, founder of All Star Digital and a CMSWire author. “Search volume will obviously be down, and the bigger shift is that Google’s dominance is at risk as users explore ChatGPT and other AI search tools. While good SEO should carry over into these LLM platforms, marketers need to be wary of upcoming Google algorithm changes designed to shift more ad revenue back to Google. This could mean a more aggressive ad environment.”

Table of Contents

Q&A on Impact for Marketers on Google Antitrust Search Ruling

Expand the questions below to learn about the impact of the Google search ruling on marketers and search strategies in a Q&A with Miranda Gahrmann, founder and global digital marketing consultant Digital Rescue Rangers:

- The Chrome Factor. First, Google does not have to sell Chrome, which is significant for SEO because Chrome serves as a substantial data collection mechanism. Google uses Chrome to render web pages and collect user experience data like Core Web Vitals, which impacts search rankings. This means that Google would continue to work in the same way we’re used to.

- Multiple search engine game. Second, Google must share parts of its Search Index (the databases that store and organize information about websites and their content) with qualified competitors. Still, companies would first need to prove they can handle the data securely, demonstrate a plan to invest and compete in the search engine and search ads markets, and not pose security risks to the U.S. Unfortunately, this search data won’t be available to SEO professionals directly. Sharing the search data with competitors addresses Google’s scale advantage where it processes nine times more queries than all competitors combined and 19 times more on mobile. As these competitors improve with Google’s data, SEO marketers will likely need to optimize for multiple search engines rather than focusing solely on Google.

- Mobile search still Google’s world. Lastly, Google can still pay partners like Apple and Samsung to keep its search engine as the default on their devices, which helps protect its dominance in mobile search. The ruling takes effect in 60 days, meaning competitive changes will develop gradually rather than immediately.

- The AI Factor in Search. Google was already facing competition from rapidly growing AI chatbots, and this pressure will only increase as better models emerge. Due to the DOJ ruling that Google is now required to make parts of its Search Index available, which could help other search engines and AI platforms to improve their results and close part of the quality gap.

- Tracking the Prompts in LLMs in Search. For marketers, this means the search market is becoming more fragmented, and relying only on Google is no longer enough. As a first step, tracking should be set up to monitor how brands appear across different search engines and AI chatbots. Prompt tracking is still in its early days, and chatbots can give different answers to the same question, but it’s still useful to see whether your brand shows up and which sources are used to generate responses, which is valuable input for your marketing strategy.

- Include log file analysis for AI crawler visits. Another useful source of data is log file analysis with tools like Botify, OnCrawl or CDNs such as Cloudflare. This helps you see whether all targeted search engines and AI chatbots can crawl your site, and how often an AI crawler visits based on a user interaction in a chatbot.

- Bake Segments into Web Analytics. It’s also smart to set up segments in your analytics tool to track visitors by platform. Early data suggests these visits can convert much better than traditional SEO traffic, for example, up to 3x higher for a large consumer brand I worked on this week. Based on these data points, some adjustments may be needed for each platform. For example, your CDN might block AI traffic by default, preventing your site from being used as a source in chatbot responses.

Overall, while the search market is becoming more fragmented, this also creates more opportunities to appear in new places, offering alternatives for when Google rankings need improvement.

Inside the US Federal Government’s Ruling on Google and Search

Back to the antitrust ruling and how this could shake up the search world.

Google does not have to sell Chrome nor must it break up its monopoly, according to U.S. District Court Judge Amit Mehta’s 230-page ruling Tuesday, Sept. 2.

The DOJ’s ruling does, however, crack open something arguably more consequential: Google must share portions of its search index and user-interaction data with qualified competitors.

That means rivals — from Bing to emerging AI search engines — will finally gain visibility into signals like crawl dates, spam scores, click patterns and the RankEmbed model used to interpret search intent.

What Google Must Cough Up to Search Competitors

The court’s ruling spells out in detail what Google must disclose — and to whom:

1. Search Index Data. Google must provide “Qualified Competitors” with a one-time snapshot of its search index. This includes:

- The unique DocID for each document and notations on duplicates.

- A DocID-to-URL map (linking identifiers to web addresses).

- Metadata such as:

- Time the URL was first seen and last crawled.

- Spam score.

- Device-type flag (mobile vs. desktop).

- Other signals recommended by the Technical Committee if deemed significant to ranking

The court limited this disclosure to a one-time snapshot (not ongoing updates) to help rivals “jump start” their indexes but prevent free-riding

2. User-Side Data. Google must share, “at marginal cost” and on a periodic basis determined with oversight, three categories of user-interaction data:

- Glue Data: Query text, language, user location/device, ranking info (blue links, SERP features), SERP interactions (clicks, hovers, time on page), and query interpretation (spelling corrections, salient terms). This also includes Navboost, Google’s memorization system of click-and-query data

-

RankEmbed Data: 70 days of search logs plus human-rater quality scores, used to train models like RankEmbedBERT. The court emphasized that only the underlying data is shared, not the models or ranking signals themselves

-

GenAI Training Data: User-side data used as training material for GenAI models deployed in Search or GenAI products that access search

3. Who Qualifies. To access this data, companies must:

- Meet approved data security standards with regular audits.

- Show a credible plan to compete in search engines or search ads.

- Not pose national security risks to the U.S.

This includes traditional engines (e.g., Bing, DuckDuckGo) and GenAI providers (like ChatGPT, Claude, Perplexity) that rely on search grounding.

Search Will Be About Data, Not the Platform

For marketers who manage SEO, the near-term impact may feel muted. Google Ads data and ranking algorithms remain off-limits, and Google still controls more than 89% of U.S. search traffic. But the fact that regulators forced any data disclosure at all signals a shift in the search ecosystem’s balance of power.

The longer-term story is bigger: SEO will no longer be a single-platform game. As competing engines gain access to Google’s scale-driven insights, marketers should prepare for a more fragmented search landscape where authority, brand visibility and customer trust matter as much as keyword optimization. As Chris Panteli, co- founder at digital PR firm Linkifi, put it in his LinkedIn post, “authority is the new SEO.”

Getting cited in tier-one publications, building digital PR momentum and showing up in AI-driven answers may soon carry more weight than jockeying for one more blue link on Google. For marketers, that means expanding strategies now — investing in credibility and multi-channel discoverability before competitors catch up.

SEOs are still trying to optimize, but with the potential democratization of data, it levels the playing field somewhat, Panteli told CMSWire.

“The biggest shift here is that SEO isn’t just about ranking on Google anymore,” Panteli said. “It’s about showing up across AI systems that are now competing for how people discover brands. Google being forced to share its search data is a clear signal that visibility is becoming less about the platform and more about the data itself. That changes how marketers need to think about SEO. And it’s a kick in the teeth for the data hoarding Lords at Google.”

If you want to be surfaced by AI search, your brand needs to show up in the kinds of sources these models trust, according to Panteli.

“That means Tier 1 media, expert commentary, industry coverage and solid third-party validation,” he said. “It’s not just a way to earn links. It’s a way to build real authority, which is now the foundation of search visibility in this new environment.”

Related Article: Survive the AI Takeover of Search — 5 Moves Every Brand Must Make

Multi-Search Engine Reality Ahead

Josie Geistfeld, content strategist at Influent, told CMSWire that in the short term nothing changes while Google appeals.

Long term, however, marketers may have to evolve from “Google-first SEO’” into multi-engine teams, “with people heavily specializing in individual platforms, heavier emphasis on content repurposing and the same expectation of constant experimentation but with the dial turned up to 11.”

How Exactly Has AI Changed the Search Game for Marketers?

That changing world of search? It’s here.

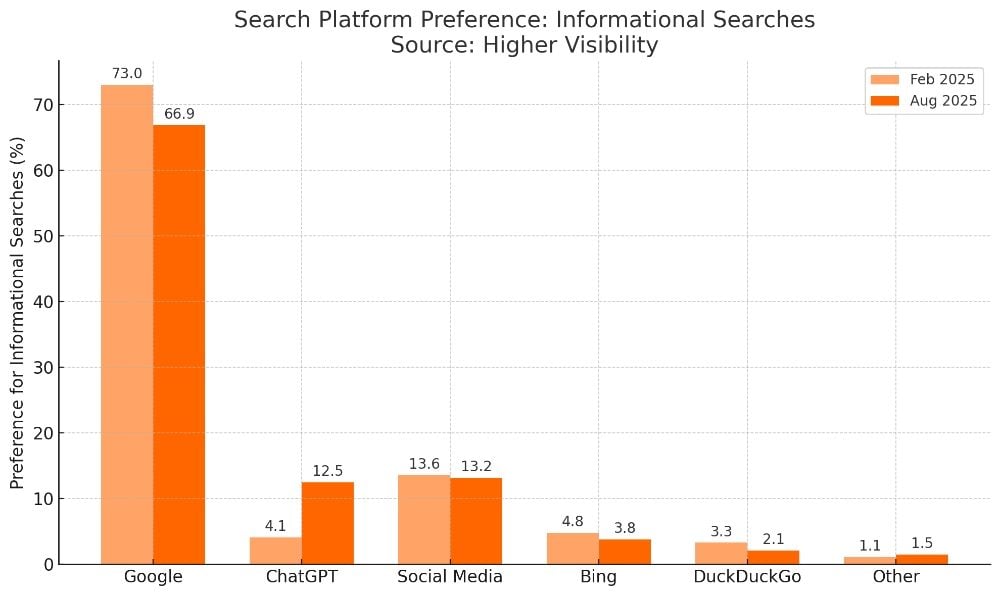

A Search Engine Land report last week showed a clear shift in how people find information online: while Google remains dominant, its grip is loosening as AI-powered assistants gain traction. According to the data, 74% of respondents still rely on Google Search — but a notable 28% are now turning to ChatGPT for answers. Other AI tools are also finding their place in the discovery ecosystem, with Perplexity (12%), Claude (8%) and Gemini (7%) capturing slices of user attention.

Further, sites like Reddit (top 10 ranking presence jumps 1,320%) and Quora (SEO visibility rises 650% in long-tail keywords) are gaining rapidly in the search world.

According to Ahrefs, here’s how the mention share world lines up for top domains across AI assistants AI Overviews (Google), ChatGPT and Perplexity.

- Wikipedia dominates all three; ChatGPT (16.3%) cites it most, then Perplexity (12.5%), then AI Overviews (8.4%).

- YouTube leads Perplexity (16.1%) and AI Overviews (9.5%) but is missing in the top in ChatGPT.

- Reddit and Quora rank high in AI Overviews (7.4% & 3.6%) but are outside the top 10 in ChatGPT or Perplexity.

Most-Cited Domains Across AI Assistants (June 2025)

Source: Ahrefs — The 10 Most Mentioned Domains for ChatGPT, Perplexity, and AI Overviews. “Mention share” = how often each assistant chooses a domain in its citations.

| Domain | ChatGPT Mention Share | Perplexity Mention Share | Google AI Overviews Mention Share | Why It Matters for Marketers |

|---|---|---|---|---|

| wikipedia.org | 16.3% | 12.5% | 8.4% | Reference-style, well-structured, and comprehensive content is consistently favored across assistants. |

| youtube.com | — | 16.1% | 9.5% | Video explainer content is highly surfaced by Perplexity and AI Overviews; consider authoritative video assets. |

| reddit.com | — | — | 7.4% | User-generated/forum content features in AI Overviews; community insights can earn visibility on Google’s AI layer. |

| quora.com | — | — | 3.6% | Q&A style pages are cited in AI Overviews; structured answers to specific questions can help discovery. |

| News outlets (e.g., reuters.com, Apple News/AP, AS.com) | ~2.6%–4.0% | — | — | ChatGPT shows a bias toward news sources; timely, reportorial content increases likelihood of citations. |

Note: Where a site has no number, that means Ahrefs reports it did not make the top-10 list for that assistant in June 2025.

Google Faces Pressure to Share Search Data as AI Rivals Gain Ground

Google earlier this year got similar pressure across the pond. Regulators in the UK pushed Google in January to share search algorithms and AI data with competitors following antitrust rulings then. The move aimed to increase competition in search markets where Google has maintained dominance for nearly two decades.

Regulatory Push for Transparency

The regulatory actions could force Google to reveal how its AI-driven features, including AI Overviews, select and display content. For marketers, this represents potential access to insights that have long been proprietary, according to industry analysts.

Google’s market share dropped below 90% for the first time in nearly a decade last year as AI-powered competitors like ChatGPT Search and Perplexity capture user attention.

AI Disruption Changes Search Dynamics

These emerging platforms focus on conversational context and user intent rather than traditional keyword matching. Research indicates that when Google’s AI Overviews appear in search results, website traffic can decline 30-70% for affected queries.

The shift forces marketers to reconsider content strategies built around traditional SEO practices. AI-powered search engines prioritize different ranking factors and user engagement patterns than conventional search algorithms.

Related Article: AI Overviews, SGE and SEO: Differences, Challenges and the Path Forward

Marketing Implications

The regulatory changes present both opportunities and challenges for marketing teams. Increased transparency could provide new data access and advertising opportunities across a more diverse search landscape.

However, marketing technology stacks and SEO strategies designed for Google’s ecosystem may require significant updates. Industry experts suggest marketers should prepare for a fragmented search environment where multiple platforms compete for user queries.

The changes echo Microsoft’s antitrust challenges in the early 2000s, though AI acceleration makes the current disruption potentially more rapid and far-reaching for digital marketing strategies.