Any rent payments you receive when you rent out your property are subject to income tax and must be declared in your Income Tax Return.

Rental income

Rental income refers to the full amount of rent and related payments you receive when you rent out your property. This includes:

- Rent of the premises

- Maintenance

- Rent of the furniture and fittings

- Rental deposit – Generally, forfeiture of the rental deposit is considered as part of your gross rent and is taxable. Where the rental deposit is forfeited due to damages to

property by tenant, you may claim expenses for costs incurred to rectify the damages. - Subletting of property – Some property owners may choose to rent out a portion of their property (i.e. subletting). For example, they rent out a spare room while still dwelling in their home. The rental income from subletting is taxable. Property

owners are required to apportion the allowable expenses incurred based on the number of rooms rented out (refer to Example 6 below). - Recovery from insurance – If you have recovered any amount from insurance on the property that is rented out, the amount recovered is taxable and should be reported as part of your income.

The net rental income after deduction of any allowable expenses is subject to income tax. It is taxable from the date it is due and payable to the property owner, and not the date of actual receipt.

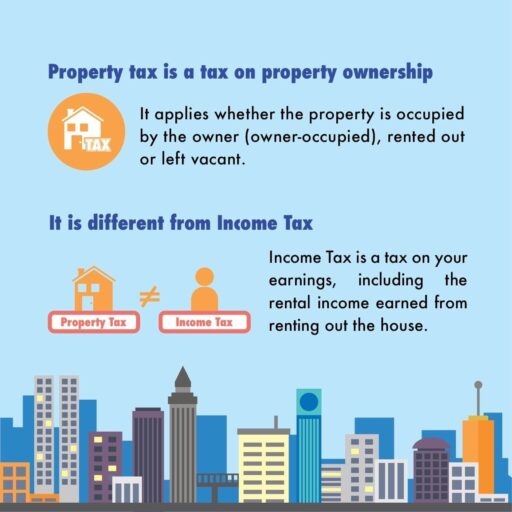

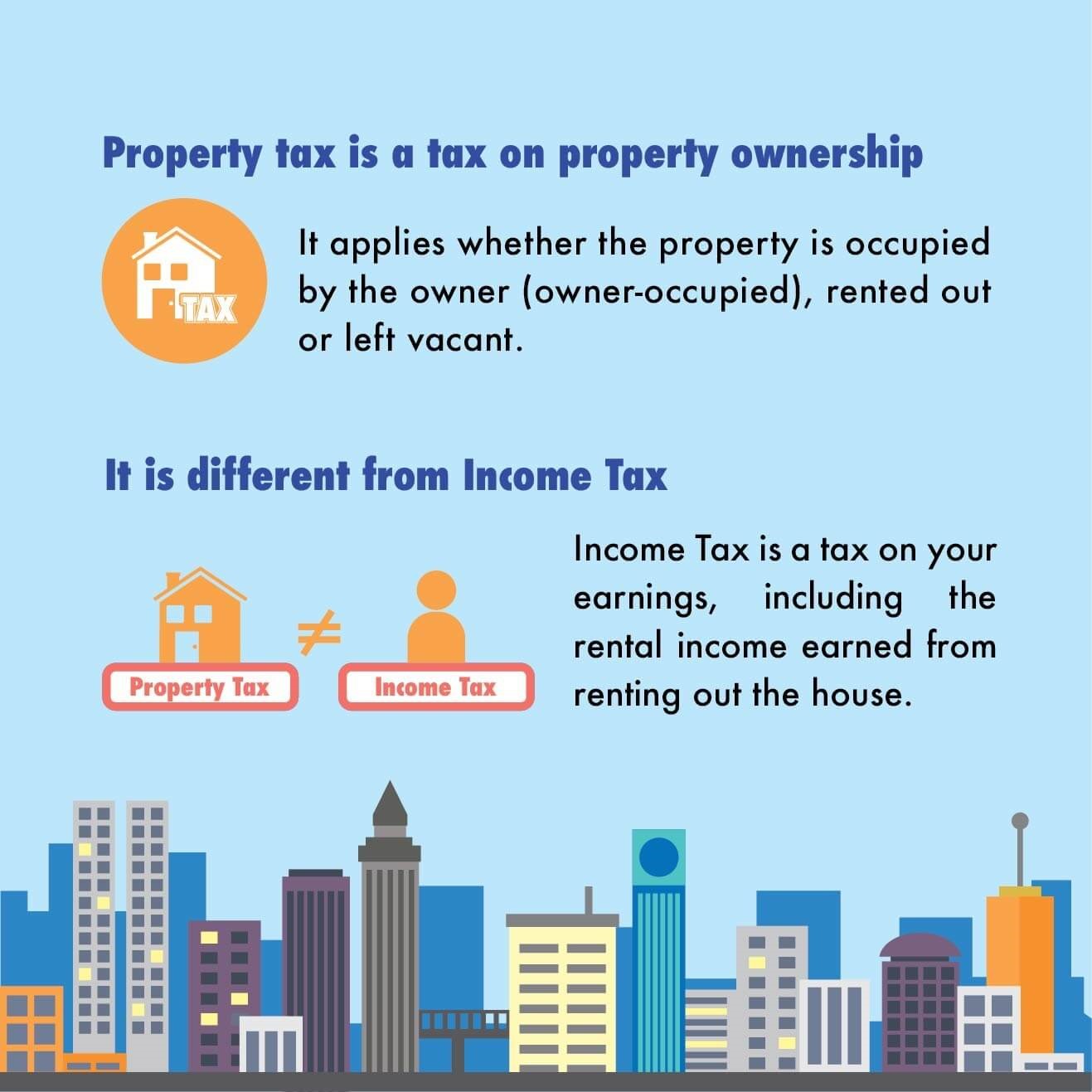

Difference between property tax and income tax

Property tax is a tax on property ownership. It applies whether the property is occupied by the owner, rented out or left vacant. It is different from Income Tax.

Income Tax is a tax on your earnings, including the rental income earned from renting out your property.

Amount of taxable rental income

| Sole ownership of property | Jointly owned property |

|---|---|

| The rental income is taxed 100% on the sole owner of the property, even if a third party receives the rent. |

The rental income is taxed on all the joint owners based on their legal share in the property. It does not matter which party receives the rent or whether the owners paid for the property. The rental loss is also apportioned to joint owners, |

Rental expenses

Expenses incurred solely for producing the rental income and during the period of tenancy may be claimed as tax deduction.

Property owners who lease their residential properties can now enjoy the convenience of pre-filled rental expenses.

To simplify tax-filing and reduce the burden of record-keeping, an amount of deemed rental expenses calculated based on 15% of the gross rent will be pre-filled in the online tax form. In addition to the 15% deemed rental expenses, property owners may

still claim mortgage interest on the loan taken to purchase the tenanted property. Please keep the supporting documents relating to the mortgage interest for at least 5 years for verification purposes. For deemed rental expenses claim, it is

not necessary to keep records of the other rental expenses incurred.

Alternatively, property owners may opt to claim the amount of actual rental expenses incurred. Please retain all supporting documents such as tenancy agreements, bank mortgage statements, invoices and receipts for at least 5 years for verification purposes.

From Year of Assessment 2022, any expenditure incurred by a landlord for the repair, insurance, maintenance or upkeep of a property when it is vacant in any part of a basis period, and any property tax paid on that property for that

vacancy period can be deducted against rental income. This is subject to the condition that reasonable efforts have been made to find a new tenant during the vacancy period(s) in between leases.

The table below lists allowable and non-allowable rental expenses:

| Type of expense |

Allowable expenses |

Non-allowable expenses |

|---|---|---|

|

Housing loans |

Interest (including late payment interest^) paid on the loan or mortgage taken to purchase the property that is rented out. (See Note 1 below) |

Repayments of the principal loan or mortgage amount (monthly instalments). Late default charges or finance fees^ imposed by banks for late repayment of loans. |

|

Property tax |

Incurred during the rental period (e.g. property tax paid for year 2024, on property rented out in 2024).* |

Penalty imposed for late payment or non-payment of property tax. Balance brought forward from previous year’s property tax. |

|

Fire insurance |

Premiums paid on fire insurance.* |

Capital sum assured on property. |

|

Repairs |

Repairs done during the rental period to restore the property to its original state.* |

Cost of initial repairs. Repairs done which result in improvement/additions and alterations. |

|

Maintenance |

Cost of maintaining the property (e.g. painting, pest control, monthly maintenance charges [including late payment charges^] to management corporations).* |

Cost of renovation, additions, alterations to the property (e.g. extension of car porch, construction of drains, cementing of walls and floors, installation of window grilles). |

|

Costs of securing tenant |

From Year of Assessment 2022: Agent’s commission, advertising, legal expenses and stamp duties incurred to obtain, grant, renew or extend a lease for first and subsequent tenants are allowed. Note: No deduction may be allowed to a person in respect of: a) any lease, or any renewal or extension of a lease, for a term that (excluding any option for the renewal or extension of the lease) exceeds 3 years; b) any acquisition, grant, novation, transfer or assignment of a lease because of any acquisition, sale, transfer or restructuring of any business; or c) a lease under an arrangement where the property is sold by, and leased back to the seller of the property.

Prior to Year of Assessment 2022, only the following are allowable: Agent’s commission, advertising, legal expenses and stamp duties for getting subsequent tenants. Agent’s commission, advertising, legal expenses and stamp duties for getting the first tenant of an additional property is deductible against the rental income of that property. |

Prior to YA 2022, the costs for getting the first tenant is not allowed.

|

|

Costs of supervision or management fees |

Costs in engaging a third party (e.g. property agent / company) to carry out activities such as ensuring rentals are paid promptly, maintenance and upkeep of the properties and attending to tenants queries and complaints.* Where the management fees is paid to a related party (e.g. relatives or own company), owners need to justify that the amount paid is at market rate and commensurate with the services rendered. |

|

|

Furniture and fittings |

Replacements of furnishings (e.g. furniture, fixtures, electrical appliances) to its original state.

Hiring of furniture. |

Depreciation of furnishings (e.g. furniture, fixtures, electrical appliances). New improvements/additions made to furnishings (e.g. furniture, fixtures, electrical appliances). |

|

Internet charges/expenses |

Paid on behalf of tenant (i.e. not reimbursed by tenant). |

Paid on behalf of tenant and reimbursed by tenant subsequently. |

|

Utility expenses |

Paid on behalf of tenant (i.e. not reimbursed by tenant). |

Paid on behalf of tenant and reimbursed by tenant subsequently. |

|

Expenses incurred on properties that are not generating rental income |

N.A. |

The relevant expenses incurred on such properties (e.g. rent, utilities, maintenance paid for own accommodation/a vacant property) cannot be claimed against the rental income generated from other properties as the expenses are capital (See Note 2 below) |

^ Only statutory fines or penalties imposed for the non-compliance/breach of a requirement of law are not deductible against your rental income.

* From Year of Assessment 2022, this includes costs incurred during the vacancy period(s) in between leases (provided that reasonable efforts have been made to find a new tenant during the vacancy period in between leases)

Note 1: Obtaining a housing loan to purchase property

- Loan obtained (by mortgaging Property A) to purchase Property B: The loan interest is deductible, provided the rental income is generated from Property B.

- Loan obtained (by mortgaging Property A) to be used for other purposes (e.g. to purchase another property for residential purpose or for business): The loan interest is not deductible against rental income of Property A as the loan is not incurred

to purchase the said property. - Overdraft obtained for financing the purchase of Property A and also for personal use: Only that portion of the loan interest applicable to the amount of loan to finance the purchase of Property A is deductible against its rental income.

- For interest incurred on refinanced loans, please refer to the administrative concession for interest incurred by taxpayers on loans to re-finance earlier loans or borrowings.

Example 2: Individuals who receive rental income from 1 property

| Categories | Rental Information | |

|---|---|---|

| Calendar year | 2023 | 2024 |

| Year of Assessment | 2024 | 2025 |

| Description of use of property | Taxpayer bought a property in May 2023. Property was under renovation for 3 months before it was rented out. In Sep 2023, the property was rented out for a period of 2 years (from Sep 2023 to Aug 2025) to its first tenant, John. Commission was paid to an agent to secure a tenant. |

In Jun 2024, the tenant terminated the lease agreement. Property was vacant for 3 months before a new tenant was secured in Oct 2024. Taxpayer has taken reasonable efforts (e.g. evidence of advertisements, engagement of an agent) to look for a tenant during the vacant period but the property was not rented out due to unforeseen circumstances (e.g. poor market sentiment or oversupply of housing in the property market). Commission was paid to an agent to secure the new tenant (subsequent tenant). During the vacant period, minor repairs were carried out on the property. |

| Allowable expenses |

1. Interest on housing loan paid for the acquisition of the property during the period of tenancy (Sep 2023 to Dec 2023); 2. Property tax paid during the period of tenancy (Sep 2023 to Dec 2023). 3. Costs of securing first tenant (e.g. agent’s commission, advertising, legal expenses and stamp duties paid) prior to the commencement of tenancy. |

1. Interest on housing loan paid for the acquisition of the property (including the vacant period) (Jan 2024 to Dec 2024); 2. Property tax paid (including the vacant period) (Jan 2024 to Dec 2024); 3. Costs of securing subsequent tenant (e.g. Agent’s commission, advertising, legal expenses and stamp duties paid); 4. Cost of repairs incurred during the vacant period. |

| Disallowable expenses | 1. Cost of renovation incurred on the property prior to commencement of tenancy. | NIL |

Example 3: Individuals who receive rental income from more than 1 property concurrently

| Categories | Rental Information | |

|---|---|---|

| Calendar year | 2024 | |

| Year of Assessment | 2025 | |

| Number of property owned |

First (Property A)

|

Second (Property B)

|

| Description of the use of property | Rented out since May 2023 | In Feb 2024, taxpayer bought Property B and made some minor repairs before it was rented out. Taxpayer rented out Property B (subsequent property) from May 2024 to Apr 2025 to its first tenant. Commission was paid to agent to secure the tenant. |

| Allowable expenses |

|

|

| Disallowable expenses | Cost of repairs incurred on Property B prior to the commencement of tenancy. | |

Example 4: Apportionment of rental expenses for property that was not rented out for the full year

You have rented out your non-residential property at a gross rent of $5,000 per month for 10 months (Jan to Oct). Thereafter, you allowed your relative to occupy your property rent free. Besides the interest of $12,000 paid on the loan taken to purchase the property, you have incurred other expenses, namely property tax of $2,400,

fire insurance of $180 and maintenance of $3,600. Your actual rental expenses are to be apportioned as follows:

| Gross rent | $5,000 x 10 = $50,000 |

| Mortgage interest | $12,000 x 10/12 = $10,000 |

| Property tax | $2,400 x 10/12 = $2,000 |

| Fire insurance | $180 x 10/12 = $150 |

| Maintenance | $3,600 x 10/12 = $3,000 |

Net rent

= $50,000 – $10,000 – $2,000 – $150 – $3,000

= $34,850

Note: the expenses incurred in Nov and Dec are not deductible.

Simplified claim for rental expenses for tenanted residential property

If you have more than one tenanted residential property and opt to claim actual rental expenses on any one tenanted residential property, you will need to apply this treatment consistently to all your tenanted residential properties. You cannot claim

15% deemed rental expenses on one tenanted residential property and claim actual rental expenses on another tenanted residential property.

If your residential property has been approved for non-residential use (e.g. child care centre or workers’ dormitory), it is not considered as a residential property for tax purposes.

The deemed expenses option is not applicable under the following circumstances:

- You did not incur any deductible expense (apart from mortgage interest) in respect of the rental income derived; or

- You derived the rental income through a partnership in Singapore; or

- You derived the rental income from a property held under a trust.

Find out more about Simplification of Claim of Rental Expenses for Individuals (PDF, 247KB).

Claim for rental expenses for tenanted non-residential property

For tenanted non-residential property, you would only be able to claim the actual rental expenses incurred. You are required to keep the supporting documents for at least 5 years for verification purposes.

Example 5: How to claim the 15% deemed rental expenses

You have rented out your residential property at a gross rent of $5,000 per month for the full year. Besides the interest of $12,000 paid on the loan taken to purchase the property, you have incurred a total amount of $7,500 on other deductible expenses,

namely property tax, fire insurance and maintenance. You may claim the deemed rental expenses as follows:

| Gross rent | $5,000 x 12 = $60,000 |

| Mortgage interest | $12,000 |

| Other expenses | $60,000 x 15% = $9,000 |

Net rent

= $60,000 – $12,000 – $9,000

= $39,000

Example 6: You are subletting in a room in your home

You are living in a 4-room flat with 3 bedrooms. You sublet one of the rooms for the full year. Your tenant pays you $600 per month as rent. The total amount of deductible expenses incurred for the whole flat is $3,000. You must apportion the allowable

expenses incurred based only on the number of rooms rented out. Alternatively, you may opt to claim the rental expenses based on 15% of the gross rental income.

Your net rent is calculated as follows:

| Rental Period for full calendar year | Computing net rent based on actual expenses incurred | Computing net rent based on simplified claim for rental expenses |

|---|---|---|

| Gross rent | $600 x 12 = $7,200 | $600 x 12 = $7,200 |

| Deductible expenses | (1 bedroom / 3 bedrooms) x $3,000 = $1,000 | $7,200 x 15% = $1,080 |

| Net rent (Gross rent – Proportion of allowable expenses allowed) | = $6,200 ($7,200 – $1,000) | = $6,120 ($7,200 – $1,080) |

Reporting rental income

You have to declare the gross rent of your property in the previous year and details of deductible expenses of each property under ‘Other Income: Rent from property’ in your Income Tax Return.

The required details include the following:

- total annual rent collected;

- total deductible expenses; and

- share of the rent (for jointly-owned property)

You may use our Rental Calculator to compute your rental income if you opt to claim actual expenses incurred.

Rental income from partnership property

If rental income is derived by a partnership from its partnership property, the rental income is to be reported in the partnership Income Tax Return (Form P).

Where rental income is received by the partnership in the business of investment holding or operating coffeeshops/eating houses/food courts, the rental income is to be reported as business income of the partnership in the partnership Income Tax Return

(Form P).

| Precedent partners | Individual partners | |

|---|---|---|

| How to report rental income by precedent partner / partner | Form P | Form B/B1 |

|

Precedent partner should file the Form P and include rental income/loss derived from partnership under “Other income – Rent”.

For each property, please include details of the gross rent (inclusive of rental of furniture and fittings, service charges received from the tenant) and expenses incurred.

Precedent partner should also enter each individual partner’s share of the rental income/loss at Partnership Allocation under “Other income from Partnership – Rent”. |

The individual partner should enter their share of rental income/loss derived through partnership under “Partnership – Rent”.

Rental deficits (i.e. excess of deductible expenses incurred to rent out the property over the gross rental received from that property) cannot be offset against other sources of income.

However, if the precedent partner of the partnership e-files the Form P by 28 Feb of the year, the partnership allocation will be pre-filled in the respective partners’ Form B/B1. |

|

| Rental income received by partnership in the business of investment holding or operating coffeeshops/eating houses/food courts |

Precedent partner should file the Form P and include rental income/loss derived from partnership as business income in the 4-line statement under “Trade, Business, Profession or Vocation”.

Precedent partner should also enter each individual partner’s share of the Divisible Profit/Loss at Partnership Allocation. |

The individual partner should enter their share of business rental income/loss derived through partnership under “Partnership – Your Share of Divisible Profit/Loss”.

However, if the precedent partner of the partnership e-files the Form P by 28 Feb of the year, the partnership allocation will be pre-filled in the respective partners’ Form B/B1. |

Reporting late or not reporting rental income

You may incur penalties for submission of incorrect returns (e.g. failing to report any rental income) to IRAS.

However, IRAS may waive the penalty if voluntary disclosure is made within the ‘grace period’ of 1 year from the statutory filing

date.

Find out more about How to Report a Mistake to Qualify for Zero Penalty or Lower Penalty.

Rental losses

Losses from renting out your property cannot be carried forward and used to offset against any other income (e.g. employment income) that you may have in the same year or in the future.

However, as an administrative concession, you may

use the rental loss of one property to offset against the taxable rental income of another property in the same year provided all the rented out properties have been rented out at market rates.

FAQs

Pre-filling of rental income from Year of Assessment 2015 onwards

Why has IRAS pre-filled these details?

To further simplify the filing obligations for taxpayers, we have pre-filled the rental details. Taxpayers only need to verify the pre-filled rental information and make amendments if necessary.

I have a rented property that was not pre-filled. I tried to enter the postal code at the rental income page to retrieve the property address. However, the system prompted ‘Enter a valid Postal Code’. What should I do?

Please provide us with the address of the property and details of the rental income and expenses via email.

Pre-filling of deemed expenses for residential properties