Originated at Nanjing University in China in the 1990s as a celebration for single people, Singles’ Day has evolved into the world’s largest online shopping festival. After having been adopted by Alibaba 2009, other Chinese e-commerce later joined the trend before it eventually jumped overseas as well. Despite there being no shortage of online shopping holidays, more and more U.S. retailers also began Singles’ Day discounts, although the day’s timing just week’s before Black Friday and Cyber Monday has probably limited its impact in the U.S.

Over the past two decades, online shopping has evolved from novelty to norm, with many Americans routinely ordering stuff online that they used to purchase in brick-and-mortar stores. These days, nearly everything can be bought online, with clothing, shoes and groceries the most popular categories, according to Statista Consumer Insights. Statista found that 93 percent of U.S. adults purchased something online in the past 12 months, with two online retailers their clear go-to shopping destinations: Amazon and Walmart.

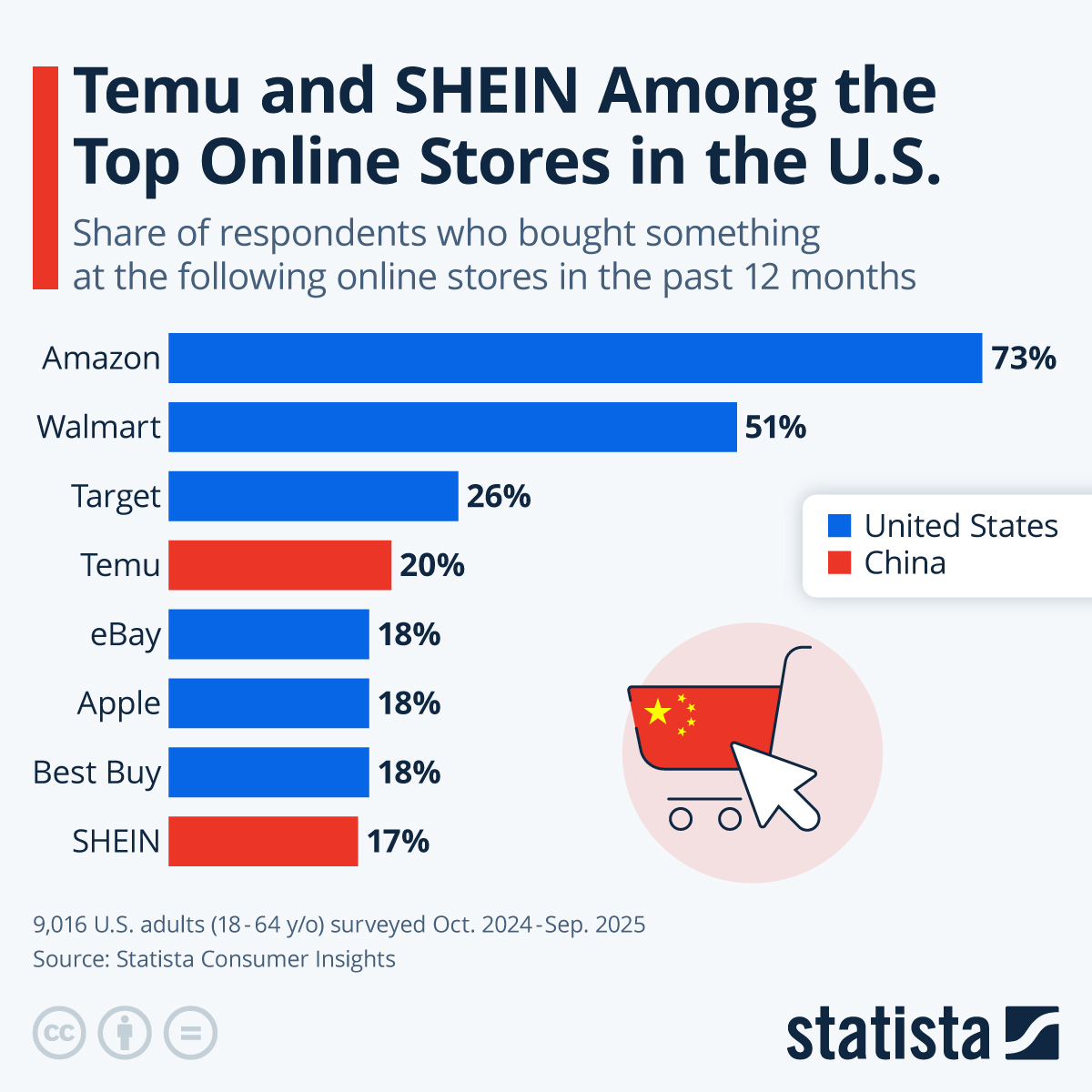

Nearly three out of four U.S. consumers (73 percent) reported making a purchase on Amazon in the past year, while more than half (51 percent) bought from Walmart online. Behind the two leaders, the market is more fragmented: Target, Temu and eBay all trail at half of Walmart’s reach, while Apple, Best Buy and SHEIN complete the top 8. Chinese Temu and SHEIN quickly captured significant market share in recent years, as they served American customers directly from China with prices that U.S. retailers struggled to compete with. Tariffs on Chinese imports and specifically the end of the de minimis exception for packages valued under $800 have forced Temu to abandon shipping directly from China, though, adding another layer of costs, which could be passed on to U.S. customers. It remains to be seen if and how the platform can manage to keep prices down while shipping from warehouses located in the United States.