Key takeaways:

- The high-end watch and jewellery category is expanding at a fraction of the overall luxury industry’s growth rate, so brands are now moving to meet customers online.

- The e-commerce success of watches, another key component of hard luxury, has encouraged jewellery houses to increase their digital efforts.

- Online shopping is a complement to physical retail, with e-tailers using private salons and personal shoppers to close the sale.

Recently a customer spent $400,000 on a ruby necklace. So far, so normal in the dizzying world of hard luxury — except the piece sold online at Moda Operandi. Net-a-Porter, too, has clocked six-figure sales for fine jewellery.

Buying haute joaillerie has long been a sanctified experience that involved going to plushly appointed sales salons and dealing with occasionally supercilious staff. That comes from a certain conservatism: even as other luxury brands embraced an influencer strategy, the likes of Bulgari and Cartier held off until recently.

The sale thus marked a watershed. Having become used to selling luxury bags and clothes for thousands of dollars online, e-commerce has finally entered the realm of high jewellery.

The watch and jewellery categories only made up 5.3 per cent of online luxury sales in 2016. But the industry is embracing the potential of exponential growth offered by e-commerce. About 80 per cent of luxury sales are digitally influenced, according to McKinsey, with the average high-end shopper interacting with a product five times before making a purchase.

The luxury watch and jewellery sector expanded by just 1.2 per cent from 2014 to 2016, a fraction of the overall luxury growth rate, making a quality digital presence of paramount importance. About 35 per cent of investment entering the jewellery industry between 2013 and 2017 went into omnichannel retailers, most of them e-commerce-based, says Sarah Willersdorf, partner and managing director at Boston Consulting Group.

The gateway to selling jewellery online

The e-commerce success of luxury watches, whose customers have been quicker to embrace shopping online, has encouraged heritage jewellery houses to invest in digital. Last year, Richemont, whose largest source of revenue is jewellery, purchased WatchFinder, a UK-based pre-owned watches sales platform.

In 2017, Cartier launched its revamped iconic Panthère watch through a pop-up store on Net-a-Porter, which is also controlled by Richemont. With prices ranging from £3,200 to £133,000, the success encouraged Cartier to establish a permanent presence on the online retailer.

Today, Cartier offers items up to £300,000 online. (Pricier sales that aren’t conducted in a store are processed over the phone.) The maison says that enabling e-commerce hasn’t cannibalised offline sales but instead brought in new customers, with its Love collection being a particular bestseller online.

China has also been a gateway, with the centrality of e-commerce shopping in Asia’s largest economy encouraging Bulgari to invest online. The typical Chinese luxury shopper is a millennial who lives on WeChat, so any jeweller without online capacity is missing out, says Jean-Christophe Babin, chief executive at the LVMH-owned house.

By the time significant numbers of Chinese consumers became affluent enough to buy haute joaillerie, the internet was already developed, so customers never became accustomed to the salon experience. Both Bulgari and Cartier, for instance, were quicker to set up on Tmall than equivalent digital platforms in other countries.

Convenience as a luxury

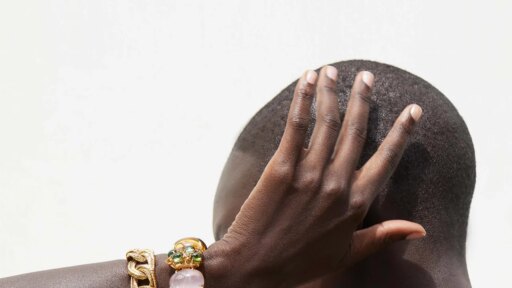

Brands and retailers are marketing the convenience of being able to buy jewellery online as a luxury for online shoppers. At Net-a-Porter, the ambition is to marry the convenience with the service offered in stores. Most of its haute joaillerie pieces are customisable online.