Back-to-school shopping is the second largest shopping season in the year. It’s not just pencils and folders, but clothing, shoes, laptops and tablets.

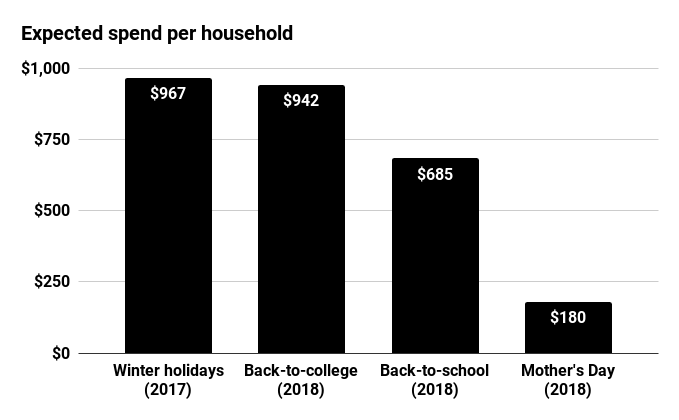

In spite of advertisements showing pigtailed girls holding rulers and boys with new backpacks, back-to-school shopping revenues are even higher for college students than their K-12 counterparts. The National Retail Federation (NRF) anticipates $685 in spending per U.S. household for those with kids in elementary through high school and $942 for households with college students in 2018. Expected winter holiday spending, in comparison, was $967 per household in 2017. NRF has not yet released expected winter holiday spend for 2018.

Supply Chain Dive, data from National Retail Federation

Not surprisingly, online shopping for this season continues to increase in popularity. The NRF annual survey showed that 49% of back-to-school consumers planned to shop online for these purchases, increasing from 44% last year.

Events such as Amazon Prime Day and retailers’ “Black Friday in July” deals kicked off the back to school shopping season, pushing it to start earlier in the year, Katherine Cullen, director of industry and consumer insights at the National Retail Federation, told Supply Chain Dive. Of those who planned to shop on Prime Day, a RetailMeNot survey showed that 91% were going to do some back-to-school shopping.

Online versus in-store: It depends on the grade level

While more than half of K-12 households are planning to do more of their back-to-school shopping online than in the past, said Cullen, that’s not causing a decrease in brick and mortar shopping.

“Back-to-college is a little different,” she said. “The top [shopping] destination is online. That has been true the last couple of years.” The trend of buying online and picking up in the store is gaining steam, or ordering online and shipping to dorm rooms. “The ways people are shopping are different because of the distance and things that surround college shopping,” she said.

Online, shoppers are buying from higher priced categories and more business-centric items, like shredders, envelopes and self-stick notes, Tia Frapolli, president of the office supplies practice at NPD Group, which conducts market research, told Supply Chain Dive in an email. Consumers tend to buy more coloring and art products, and those they can physically interact with in physical stores.

Some shoppers prefer to order online for some supplies, saving the in-store visit for their kids to help select items like backpacks or clothes, said Cullen.

Case study: How Walmart eases the school shopping experience

To ease the dorm buying experience, Walmart introduced its “buy the room” concept. They curated nine rooms with different style accessories and 20 popular items. Shoppers can add groups of items to the cart for one dorm room look. The immersive experience helps customers see what an item looks like in a room. “They’re using online tools to engage, whether they choose to buy online or in the store,” Cullen said.

Walmart added school-specific shopping lists to its app, including individualized teacher lists to make it easier for families. Shoppers can use these lists to find the right aisle in the store. They added a teacher shop online as well, pairing it with a dedicated section in 2,100 stores featuring classroom décor items.

Walmart held a quarterly wellness day during July to give families another reason to come in. “They’re offering in-store events where you can get an immunization and do some back-to-school shopping, tying a purpose or experience to the store visit,” Cullen said.

Blending online and brick and mortar

Retailers are using various methods to bring shoppers online for the seasonal purchases, including free shipping, discounts on online orders and playing up convenience by offering online school list fulfillment options, said Frapolli.

There are downsides to online shopping, though, as it minimizes the impulse purchases in the store.

“When we look at how people are shopping, it’s important to remember that back-to-school shopping is taking place in the broader context of the retail environment,” said Cullen, and that means consumers shopping across multiple channels and in multiple ways. “People still like to touch and feel products. They like the immediacy the store offers,” she said. “Even with two-day shipping, people don’t want to wait.”

Retailers adapt logistics and timing to changing sales models

Both shipping and in-store fulfillment bring their own logistics challenges. Most major retailers are already integrating their online and in-store inventories to manage the stock, said Cullen.

The larger displays of back-to-school items are only available for a limited window in the store, while online the season never ends, particularly for the larger stores, said Frapolli. That sales window may differ per category.

Electronics used to be a popular back-to-school category, and it still is for college shoppers, who may need a new laptop, tablet or accessories as the school year starts. But the K-12 group is now buying electronics when needed, rather than just before school begins.

“Electronics are really integrated into family life, not just for school work, but it’s how you stream entertainment, listen to music and communicate with family. So they tend to buy year-round when due for an upgrade,” Cullen said.

If it seems like the back-to-school shopping season is getting longer, it is, just as the holiday shopping season lengthened.

Katherine Cullen

Director of industry and consumer insights, National Retail Federation

Cullen sees bigger items selling earlier in the season, and apparel and school supplies selling closer to the start of school. That could be because households are waiting for teacher lists and making sure to buy clothing for growing kids closer to when it’s needed. She mentioned that Macy’s just started their back-to-school advertising campaign in early August.

Deloitte’s back-to-school survey noted that 62% of shoppers planned to start before August, and they’ll spend about $100 more than those who start later. This allows retailers to offer promotions from mid-July to mid-August, with an estimated $18 billion in shopper purchases made for school shopping, the largest spend for the season.

If it seems like the back-to-school shopping season is getting longer, it is, just as the holiday shopping season lengthened, said Cullen. “People are giving themselves more time than they used to, partly to stretch out their budgets, but partly because they believe the early promotions they’re seeing are too good to pass up,” she said. That includes the relatively new Black Friday in July promotion and Prime Day.

But consumers are keeping their eyes on promotions all season long. “Based on last year, customers are shopping earlier, but shopping all the way to the end. They’re keeping an eye on what gives them the most value.”

Correction: A previous version of this article misstated the NRF data on expected household spend.