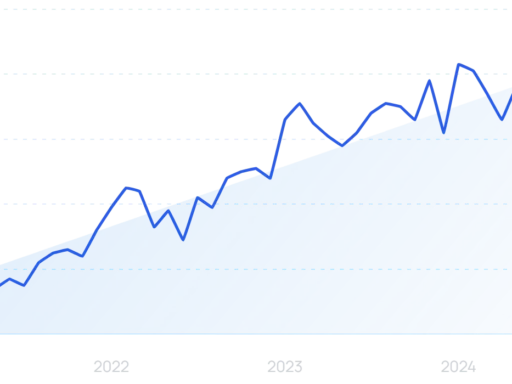

October ecommerce sales increased in 2025 compared to that month the prior year, as generative AI increasingly factors into online retail, according to data from Adobe Analytics.

Adobe data indicates that traffic to U.S. retail websites from generative AI sources has begun to convert at a higher rate than traffic from non-AI sources. It said it first “observed a material surge in generative AI traffic to U.S. retail sites (measured by shoppers clicking on a link)” during the 2024 holiday shopping season.

Adobe said it bases its insights on data from more than 1 trillion visits to U.S. retail sites. Additionally, Adobe factored in data from a survey of more than 5,000 U.S. consumers. The “companion survey,” it said, “provides an additional layer of context on how consumers are leveraging AI in their online shopping journey.”

Additionally, more than 130 of the Top 2000 online retailers in North America use Adobe’s ecommerce platform. Those retailers combined to bring in more than $44.2 billion in 2024 ecommerce sales.

Retail categories with the highest ecommerce growth in October

Halloween also played a role in the sales growth as consumers added holiday décor to their shopping lists. Ecommerce sales of holiday décor increased 130% compared to “average spend levels” in September, according to Adobe.

Among the other categories to see ecommerce sales growth were hand tools and power tools (up 83% and 62%, respectively), as well as:

- E-readers (up 81%)

- Refrigerators and freezers (up 55%)

- Headphones and speakers (up 52%)

- Phone accessories (51%)

- Video games (41%)

- Outerwear (up 38%)

Ecommerce sales in October 2025

U.S. consumers spent $88.7 billion in October ecommerce sales, according to Adobe Analytics. That’s 8.2% year-over-year growth. Mobile spending accounted for 51.4% of total October ecommerce sales, per Adobe. That’s $45.6 billion, which is an 11.6% year-over-year increase.

Buy now, pay later (BNPL) accounted for $7.1 billion — or 8% — of October ecommerce sales. BNPL usage increased 7.6% year over year in October.

Adobe data showed a spike in online sales during Amazon’s October Prime Day event. During the event, which ran Oct. 7 and 8, consumers spent $9.1 billion across U.S. retail websites. That indicates that — outside of what consumers spent on Amazon itself — the Prime Day event helped generate 10.26% of October ecommerce sales. The total amount consumers spent online during the October Prime Day event is also up 7.3% compared to during the prior year’s October event.

Also in October, ecommerce prices increased 1.4% year over year, according to data from Signifyd, a fraud-prevention technology provider. Based on Signifyd data, online retail sales increased 11% year over year in October 2025. It also found that the average online order value (AOV) in October grew 5% year over year. Meanwhile, the average number of items in digital shopping carts increased 31%.

“Widespread tariffs on imports no doubt contributed to the year-over-year rise in average prices,” according to Signifyd.

Online prices also increased in September (0.82%), according to Signifyd. That marked the first time in two years that online prices had inflated year over year.

“The price increases in October were notable because in the post-pandemic era, ecommerce prices have had a deflationary effect, trending down year over year due to the intense competition, maximum transparency and vast selection the online world provides,” Signifyd said.

More than 200 of the Top 2000 online retailers in North America use Signifyd for fraud prevention and payment security. Those retailers combined to bring in more than $224 billion in 2024 ecommerce sales.

How much did consumers use generative AI to make purchases in October?

In October 2025, traffic from generative AI sources increased 1,200% year over year, according to Adobe Analytics data.

Similarly, Signifyd data indicated a 1,247% increase in transactions that resulted from traffic AI agents referred in October 2025 compared to November 2024. The value of those transactions increased by 894% in October 2025 over November 2024.

“This holiday season and its dramatic increase in AI-driven shopping will provide online brands with a living laboratory to dig into the significance and idiosyncrasies of agentic commerce,” said Mike Cassidy, head of storytelling at Signifyd. “It’s a channel that will only continue to grow in volume and complexity, so these early lessons will prove to be invaluable.”

And the consumers who landed on a retail site through a generative AI recommendation were 16% more likely to convert, Adobe found. That compares to traffic from paid search, affiliates and partners, email, organic search and social media.

Consumers were also more likely to convert after visiting a site based on generative AI recommendations in September (5% more likely than other sources).

September and October indicate a shift in usage from August. In August, Adobe had found consumers were 9% less likely to convert when directed to sites through generative AI sources.

“This trend reversal shows that consumers are increasingly comfortable completing a transaction directly after an AI-powered chat or browser experience, condensing the path between research/consideration and final purchase,” according to Adobe. “As a result of the shift in conversion, visits from generative AI sources now generate 8% more revenue per session.”

Additionally, Adobe found that consumers arriving on retail websites from generative AI sources were 13.6% more engaged than those referred by non-AI sources. In other words, they’re exploring more content on the retail site. That includes 44% longer visits as well as 12% more pages per visit. They’re less likely to leave immediately, Adobe said, as their bounce rate was 31% lower in October.

“This indicates that with AI tools, shoppers are becoming more informed and able to pinpoint the most relevant retailers for their needs,” Adobe said.

Click here to read last month’s update on U.S. online retail sales.

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the online retail industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, X (formerly Twitter), Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.