Subsea fiber-optic cables, a critical information and telecommunications technology (ICT) infrastructure carrying more than 95 percent of international data, are becoming a highly consequential theater of great power competition between the United States, China, and other state actors such as Russia. The roughly 600 cables planned or currently operational worldwide, spanning approximately 1.2 million kilometers, are the world’s information superhighways and provide the high-bandwidth connections necessary to support the rise of cloud computing and integrated 5G networks, transmitting everything from streaming videos and financial transactions to diplomatic communications and essential intelligence. The demand for data center computing and storage resources is also expected to increase in the wake of the artificial intelligence revolution. Training large language models takes enormous, distributed storage to compute, and if those networks are globally oriented, they will require additional subsea capacity to connect them. These geopolitical and technological stakes necessitate a consideration of the vulnerabilities of subsea systems and the steps the United States can take to fortify the digital rails of the future and safeguard this critical infrastructure.

Undersea Cables: Why Do They Matter?

Subsea cables are critical for nearly all aspects of commerce and business connectivity. For example, one major international bank moves an average of $3.9 trillion through these cable systems every workday. Cables are the backbone of global telecommunications and the internet, given that user data (e.g., e-mail, cloud drives, and application data) are often stored in data centers around the world. This infrastructure effectively facilitates daily personal use of the internet and broader societal functions. In addition, sensitive government communications also rely extensively on subsea infrastructure. While these communications are encrypted, they still pass through commercial internet lines as data traverses subsea infrastructure. Subsea cables carry a much larger bandwidth and are more efficient, cost-effective, and reliable than satellites; consequently, they have been credited with increasing access to high-speed internet worldwide, fueling economic growth, boosting employment, enabling innovation, and lowering barriers to trade. These networks are now indispensable links for the modern world and are pivotal to global development and digital inclusivity.

Cable Laying, Ownership, and Control

Undersea cables are built, owned, operated, and maintained primarily by private sector companies. Approximately 98 percent of the world’s undersea cables are manufactured and installed by four private firms: in 2021, the U.S. company SubCom, French firm Alcatel Submarine Networks (ASN), and Japanese firm Nippon Electric Company (NEC) collectively held an 87 percent market share, with China’s HMN Technologies, formerly known as Huawei Marine Networks Co., Ltd., holding another 11 percent. Commercial undersea cables can be owned by a single company or a consortium of companies, including telecommunication providers, undersea cable companies, content providers, and cloud computing service providers. Amazon, Google, Meta, and Microsoft now own or lease around half of all undersea bandwidth worldwide. The companies that build and own these cables often lease out bandwidth on their cables through indefeasible rights of use (IRUs), which grant long-term access to a portion of the cable’s capacity. IRU holders can also lease this bandwidth to other third parties, creating a layered leasing market that extends the cable’s reach and utility across various sectors and regions.

China’s rapid emergence as a leading subsea cable provider and owner has been the centerpiece of Beijing’s ambitious Digital Silk Road initiative launched in 2015, which aims to capture 60 percent of the global fiber-optic cable market by targeting emerging economies in Asia, Africa, the Middle East, and the Pacific. While Chinese companies have been recently blocked from subsea cable projects involving U.S. investment and firms due to U.S. concerns about the national security risks that come with HMN Technologies’ unbridled growth, the company has provided 18 percent of the subsea cables (in terms of the total length of cable) that have been laid worldwide over the past four years. HMN Technologies has also become the world’s fastest-growing subsea cable builder over the past 10 years. A 2020 Federal Communications Commission (FCC) report referenced the fact that HMN Technologies has “built or repaired” almost 25 percent of subsea cables and is due to build only 7 percent of the cables currently under development globally, perhaps indicating a potential trend of the Chinese firm’s slowing control over international cable construction.

The Vulnerability of Cable Systems and the Potential for Chinese Exploitation

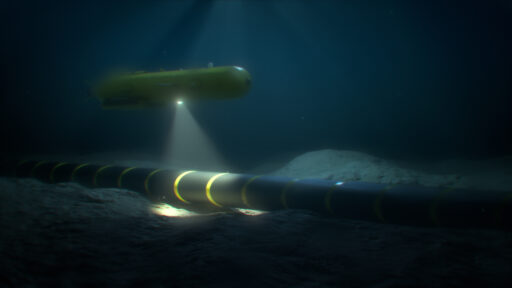

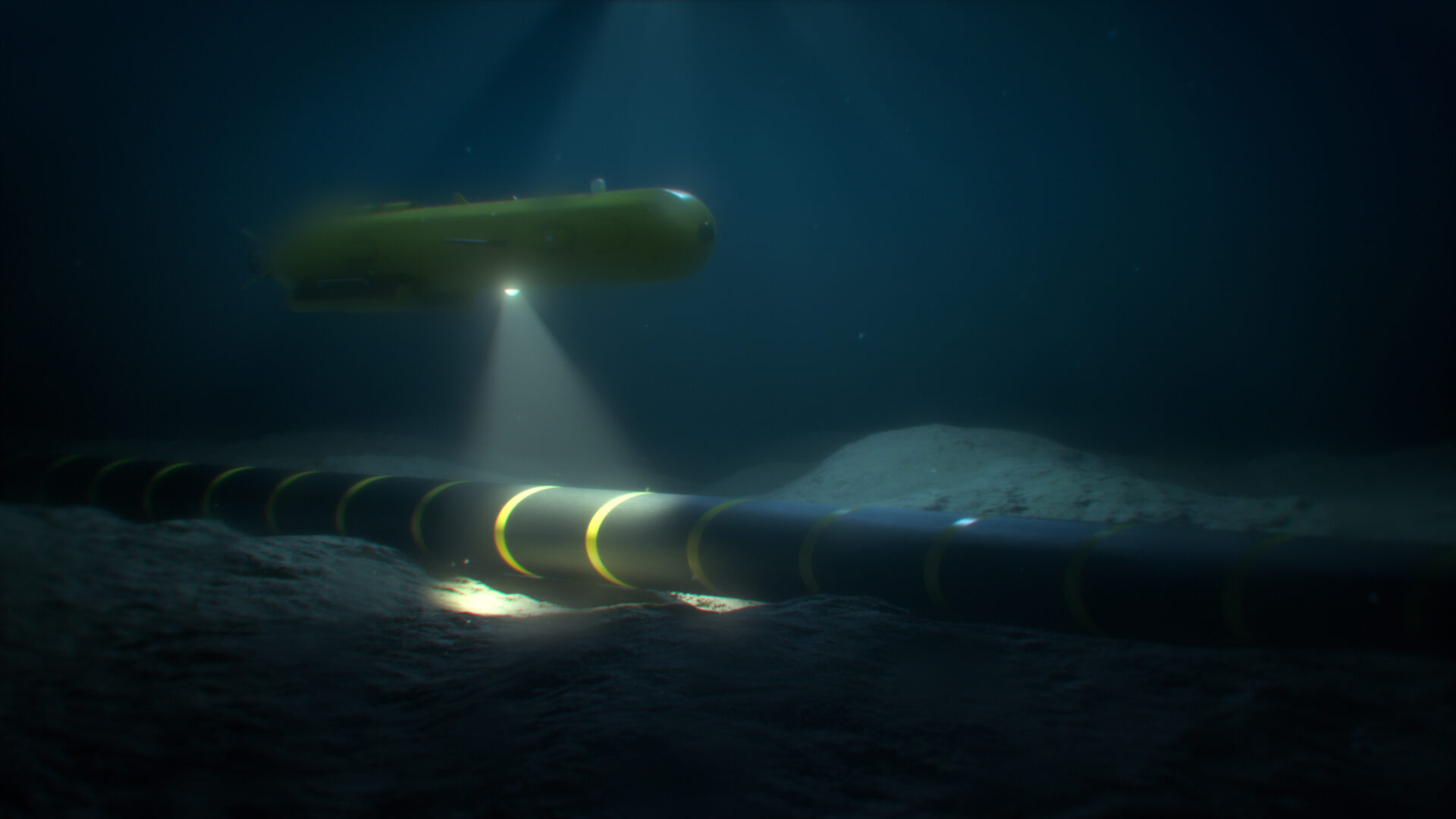

Undersea cables can be highly vulnerable to a variety of factors. Most cable damage is unintentional, mainly stemming from accidental human interaction with the cables. Still, potential hazards to the cables range from anchoring and fishing equipment to extreme weather such as earthquakes and landslides. Damage to submarine cables is relatively common—an estimated 100 to 150 cables are severed each year—mostly from fishing equipment or anchors.