Market Statistics

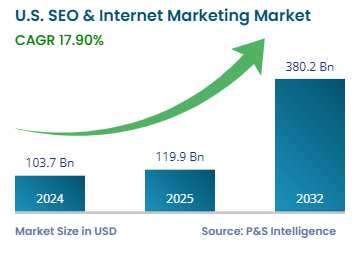

| Study Period | 2019 – 2032 |

| 2024 Market Size | USD 103.7 Billion |

| 2025 Market Size | USD 119.9 Billion |

| 2032 Forecast | USD 380.2 Billion |

| Growth Rate(CAGR) | 17.9% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

| Largest End User Category | E-Commerce |

Growth Forecast

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

U.S. SEO & Internet Marketing Market Overview

The U.S. SEO & internet marketing market was valued at USD 103.7 billion in 2024, and this number is expected to increase to USD 380.2 billion by 2032, advancing at a CAGR of 17.9% during 2025–2032.

This is because of AI developments, modifications to search algorithms, and rising digital trends. AI technology-enabled content optimization tools, voice and visual search capabilities, and personalized marketing approaches are transforming how businesses achieve online visibility. High-quality content and optimal user experience are necessary for maintaining strong Google rankings because of the company’s focus on Experience, Expertise, Authoritativeness, and Trustworthiness (E-E-A-T) and Core Web Vitals. Moreover, businesses will get new opportunities in such disciplines as short-form video content, approaching data from a privacy standpoint, and automation in digital marketing. Companies that adapt to the trends of intent-based queries and localized results will be ahead in the digital landscape.

Segmentation Analysis

Component Insights

Services dominate the market with 70% share, and they also have the higher CAGR, of 20%. This is because only a handful of companies take care of digital marketing themselves. A huge number of third-party digital marketing companies and freelancers based in the U.S., LATAM, Asia, and Europe, provide different services either individually or as part of comprehensive packages.

Major components covered in this report:

- Software

- Cloud-based

- Keyword-based

- Analytics and reporting

- Social media optimization (SMO)

- International SEO

- Others

- Services (Larger and Faster-Growing Category)

- On-page optimization

- Off-page optimization

- Technical SEO

- Local SEO

- SEO auditing

- Reputation management

- Competitor analysis

- UX-focused SEO

- Mobile-first SEO

- Ethical SEO practices

- Education and training

Digital Channel Insights

Search Engine Optimization (SEO) is the largest category with 55% share. Companies that want to boost their online presence and attract visitors organically through their sites need SEO. Search engine results page (SERP) ranking improvements require various strategies, including keyword optimization, content creation, and technical enhancement. Therefore, SEO practices have become standard across all industries, including e-commerce and healthcare.

The digital channels covered in this report:

- E-Mail Marketing

- Search Engine Optimization (SEO) (Largest Category)

- Interactive Consumer Website

- Online Display Advertising

- Blogging and Podcasting

- Social Networking Market

- Mobile Marketing

- Viral Marketing

- Digital OOH Media

- Online Video Marketing (Fastest-Growing Category)

- Others

Product Type Insights

Content SEO is the largest category with 75% share. Content serves as the core element of SEO because strong content optimization helps sites improve rankings and attract organic visitors. The application of content SEO produces optimized material that matches keywords, to fulfill user inquiries with valuable information. Content SEO remains prevalent because businesses in all industries heavily depend on this strategy to improve their online visibility.

Major product types covered in this report:

- Content SEO (Largest Category)

- Technical SEO

- Product Page SEO

- Voice Search SEO

- Local SEO

- AI-Driven SEO Tools (Fastest-Growing Category)

Deployment Mode Insights

Cloud is the largest category with 65% revenue because this system offers adaptability, economic benefits, and flexible access. Businesses of different scales can benefit because it provides remote operations, easy collaboration, and self-updating functionality, which minimizes IT support needs.

The deployment modes covered in this report:

- Cloud (Largest Category)

- On-Premises

- Hybrid (Fastest-Growing Category)

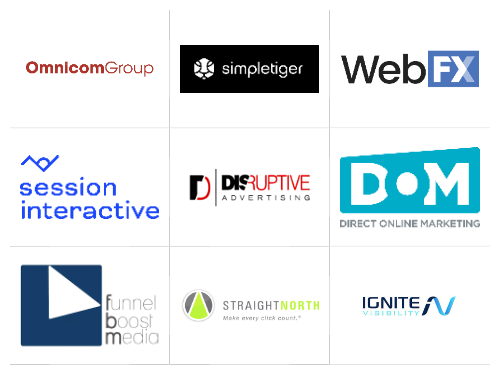

Enterprises Size Insights

Large enterprises dominate the market with 55% revenue because they invest substantial budgets in comprehensive SEO and internet marketing solutions. Large enterprises need advanced specialized solutions for their extensive internet presence because they must strive to maintain their competitive position. Large enterprises often maintain dedicated marketing departments and access the latest technological tools.

The enterprise sizes covered in this report:

- Large Enterprises (Larger Category)

- Small and Medium-Sized Enterprises (SMEs) (Faster-Growing Category)

Platform Type Insights

Mobile is the largest category with 45% revenue due to the massive change in consumer behavior, visible in the rising usage of the internet through mobile devices. People widely use their mobile devices for browsing content and shopping because of the rapidly increasing preference for on-the-go leisurely activities. Industry leaders optimize their mobile platforms to deliver seamless user experiences because this practice maintains excellent search rankings and boosts user involvement.

The platform typed covered in this report:

- Desktop

- Mobile (Largest and Fastest-Growing Category)

- Others

End-Use Industry Insights

E-commerce is the largest category with 30% share because these businesses utilize SEO to increase traffic, rankings, and sales on their websites. The growing online shopping trends and need for successful digital marketing drive this category. As per the U.S. Census Bureau, Americans bought goods worth USD 308.9 billion online in the fourth quarter of 2024, and this value was 2.7% more than the third quarter.

The end-use industry studied in this report:

- E-Commerce (Largest Category)

- Real Estate

- IT Software Development

- SaaS Companies (Fastest-Growing Category)

- Tech Services

- Recreation

- Hospitality

- Healthcare

- Education

- Others

Drive strategic growth with comprehensive market analysis

U.S. SEO & Internet Marketing Market Regional Outlook

The Western region is the prime revenue contributor. A high level of tech company and startup activity in Silicon Valley and other areas of California, along with Seattle, leads to a substantial demand for SEO and digital marketing services.

The South is the fastest-growing region because of the increasing presence of companies of all kinds. Moreover, with the increasing technical understanding in the region, companies based here are adopting the best SEO practices.

These regions are covered:

- West (Largest Region)

- South (Fastest-Growing Region)

- Midwest

- Northeast

U.S. SEO & Internet Marketing Market Share

The market is fragmented as numerous specialized service providers cater to different businesses within various industries with unique needs. This is also due to the fast technological advancements and changing consumer behavior. Moreover, apart from third-party digital marketing firms, there are a huge number of individual freelance marketers, who can be easily contacted via the classifieds. Additionally, most big companies in the country outsource a major chunk of their digital marketing activities to agencies based in China, India, and other developing countries.

U.S. SEO & Internet Marketing Companies:

- First Page Sage Inc.

- WebpageFX Inc.

- Pittsburgh SEO Services LLC

- Straight North LLC

- Thrive Internet Marketing Agency

- Ignite Visibility LLC.

- Session Interactive LLC

- Disruptive Advertising Inc.

- Omnicom Group Inc.

- Direct Online Marketing

- Funnel Boost Media

- SimpleTiger LLC