![A ″closing down″ banner is hung outside the Raboum Outlet near Seoul National University in Gwanak District, southern Seoul, on Dec. 8. [NOH YU-RIM]](https://www.dotdesh.com/wp-content/uploads/2025/12/5449e90c-01a9-477f-b2a5-76ad8abd8df6.jpg)

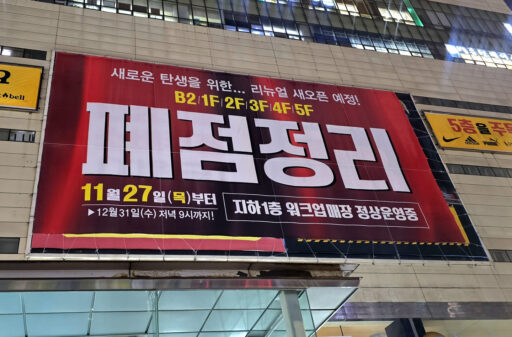

A ″closing down″ banner is hung outside the Raboum Outlet near Seoul National University in Gwanak District, southern Seoul, on Dec. 8. [NOH YU-RIM]

On Dec. 8, a large banner reading “Closing Down Sale” in Korean covered part of the exterior of the Raboum Outlet near Seoul National University in Gwanak District, southern Seoul. The outlet, which has been in business for nearly two decades since opening in 2006, is scheduled to close for good on Dec. 31.

Inside, signs advertising farewell sales were next to piles of unsold clothing and accessories — but few customers were in sight.

“Outlet brands feel a bit outdated, so I usually buy clothes online,” said Ko Seung-jae, a resident of Gwanak District.

Han Hee-jae, who had just bought gloves at a discount, added, “Outlet clearance items used to be much cheaper, but now they don’t seem any cheaper than what I can find for sale online.”

Korea’s overall offline retail sector continues to struggle, and urban outlets in particular are seeing sharp declines in purchases. “In the early 2010s, outlet stores attracted families and helped drive industry performance,” said an industry source. “They even pushed department stores to become more experience-oriented shopping spaces.”

But urban outlets have since found themselves caught between large shopping complexes that emphasize interactive experiences and e-commerce platforms that offer more competitive prices. Complexes including HDC Group I’Park Mall and Shinsegae Property’s Starfield Mall are enticing customers with popular fashion labels and interactive pop-up stores.

By contrast, the Lotte Factory Outlet in Gasan, which opened in 2016, closed in September before it could celebrate its 10th anniversary. The store’s revenue last year dropped by 9.4 percent on year to approximately 22.1 billion won ($15 million). E-Land Retail’s NewCore Outlet in Nonhyeon, Incheon, also shut down in June.

![Products are piled up inside the Raboum Outlet near Seoul National University in Gwanak District, southern Seoul, on Dec. 8. [NOH YU-RIM]](https://www.dotdesh.com/wp-content/uploads/2025/12/03e4899d-e3b7-42d4-b1f2-66f37bafc93f.jpg)

Products are piled up inside the Raboum Outlet near Seoul National University in Gwanak District, southern Seoul, on Dec. 8. [NOH YU-RIM]

The growth of e-commerce poses another major threat to urban outlets, especially as some online platforms are solely dedicated to offseason and clearance inventory. According to fashion platform Zigzag, operated by Kakao Style, transactions in its “Jikjin Outlet” category — which offers discounts on past-season merchandise — rose by 35 percent between September and November compared to the same period last year. During those months, spending by consumers in their 40s jumped by 72 percent, indicating growing online outlet use across age groups.

As of this month, Hyundai Department Store operates four urban outlets, Lotte Shopping nine and E-Land Retail 41. Since the Covid-19 pandemic began in 2019, Lotte has closed one location, and E-Land has closed seven.

“Urban outlets were once highly competitive brick-and-mortar shopping venues […] 10 to 20 years ago,” said Lee Jung-hee, an economics professor at Chung-Ang University. “But today, they are falling behind in regard to consumer trends and failing to attract foot traffic. Unlike premium outlets in the suburbs, which are built on larger areas, urban outlets are constrained by space, so they face limits in offering new content.”

![Customers wait in line at a Musinsa Megastore inside I'Park Mall in Yongsan, central Seoul, on Dec. 11. [YONHAP]](https://www.dotdesh.com/wp-content/uploads/2025/12/fc886e8e-a07b-4001-9a8d-e1f7f0e371a7.jpg)

Customers wait in line at a Musinsa Megastore inside I’Park Mall in Yongsan, central Seoul, on Dec. 11. [YONHAP]

Major retailers are responding to the slump by revamping their remaining urban outlets. In March, Hyundai Department Store redesigned the second floor of its Hyundai City Outlet in Dongdaemun as “Seoul Edition,” a content-based space showcasing modern Seoul style and Korean culture. In April, Lotte Shopping doubled the size of its food court at its Cheongju outlet. E-Land Retail is upgrading food and beverage brands at key locations and introducing more nonfashion retailers such as Olive Young and Daiso to draw in shoppers.

“Urban outlets have lost their competitiveness due to the rise of e-commerce and stagnation in the fashion sector,” said Jung Yeon-sung, a business professor at Dankook University. “Now is a critical time for them to analyze consumer demand in each commercial zone, develop specialized store concepts and diversify product categories.”

This article was originally written in Korean and translated by a bilingual reporter with the help of generative AI tools. It was then edited by a native English-speaking editor. All AI-assisted translations are reviewed and refined by our newsroom.

BY NOH YU-RIM [[email protected]]