In 2025, the idea that a major fashion brand does not sell online sounds as outdated as sending letters via carrier pigeon. Nevertheless, here is Primark, with over 460 stores in 17 countries and an army of loyal customers, steadfastly resisting entry into eCommerce.

In recent years, its steps in this domain have been very modest. After a couple of years of testing, last May Primark customers in the United Kingdom were able to access the click and collect service in a selection of the brand’s physical stores. Now, as another step forward, it has just launched its first mobile app, but only in two markets: Ireland and Italy. The app does not allow online purchases; it is designed, essentially, to enhance the physical shopping experience. It allows users to browse products, check real-time availability in store, save favorites, locate stores, and receive personalized notifications about new arrivals and collections.

The company will use both markets—one established and one growing—as testing grounds to analyze user behavior before expanding the app to other countries, including the United Kingdom, over the next 18 months. In doing so, Primark acknowledges that customers begin their shopping journey online, but continues to double down on its physical model.

In the era of Shein, Temu, and one-click shopping, why does the king of European low cost remain reluctant to enter the world of eCommerce?

A story woven through a network of physical stores

Primark was founded in 1969 in Dublin as Penneys, with a mantra it has never abandoned: to sell fashion at irresistible prices through ultra-thin margins and massive volume. As explained on its website: “Primark aims to offer affordable options for everyone.”

The formula for its success, which has enabled it to expand from Ireland to the rest of the world, combines large-batch production, fast inventory turnover, and central locations that invite shoppers to browse and buy. This strategy is similar to what, from another corner of Europe, Inditex achieved with Zara. (Allow me to clarify: I am saying similar, not identical. Zara opted for shorter collections, faster rotation, and above all, more attention to design and quality—enabling them to reach a different price level.)

The result: a customer who enters in search of one item and leaves with an XXL bag—and without feeling as though they have overspent. Primark’s business model is not designed for purchases of just one or two units, but rather for full physical “carts.”

eCommerce: the cost of a click is too high

At first glance, selling online would appear to be a logical next step for a fashion company seeking growth. In fact, you only have to look at the Spanish eCommerce landscape to see that the fashion sector is the only one daring to challenge the omnipresent and almighty tourism sector.

However, this is at the heart of the matter: the logistics and return costs associated with eCommerce would undermine Primark’s recipe for success.

(Or at least, that is Primark’s belief)

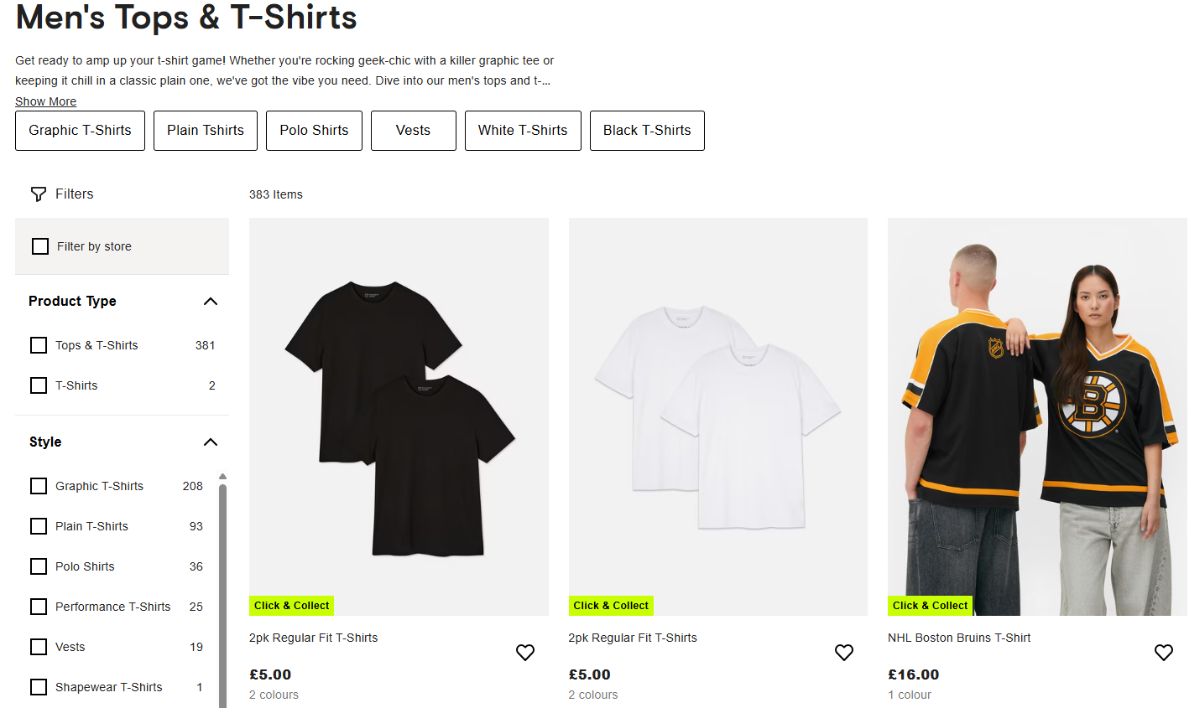

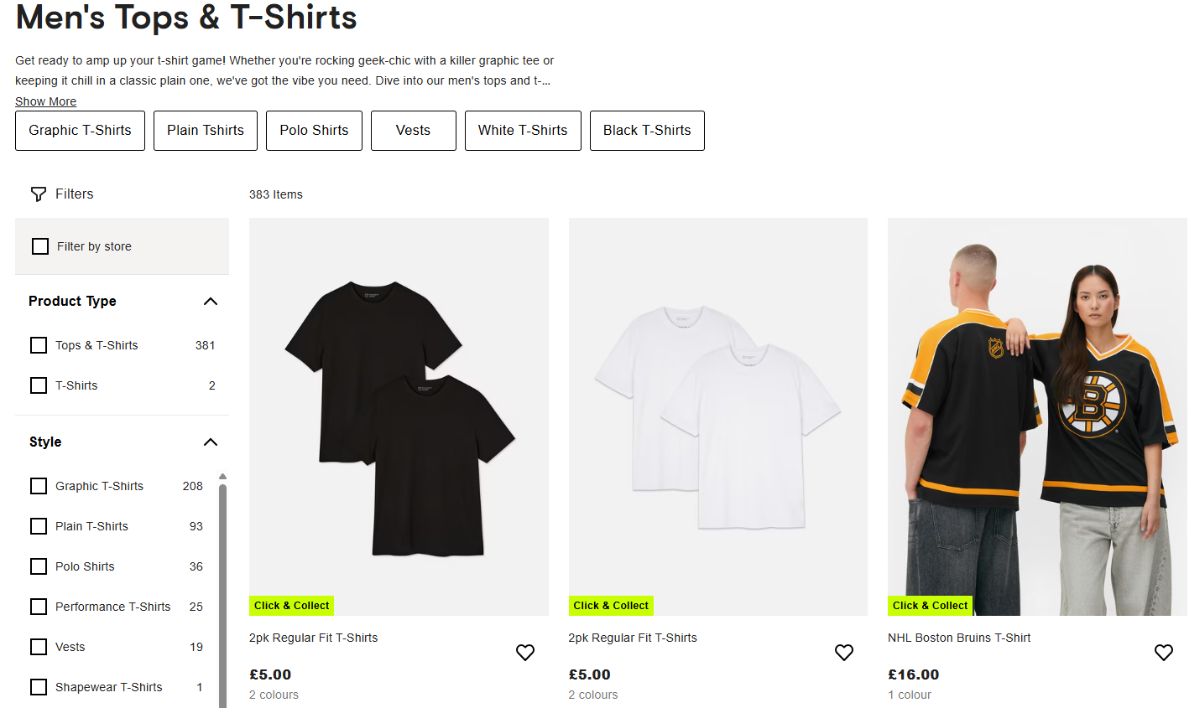

Let us take a look at its catalogue: as you will see, there are dozens of graphic tee options for under £7.00. But shipping just one of these items to a customer’s home could incur a very similar cost. Moreover, it is necessary to consider that fashion is the online sector with the highest rate of returns (due to issues such as sizing, customer preference after trying on, bracketing, etc). Processing each return can be very expensive.

In fact, as far back as 2019, John Bason, Chief Financial Officer of Associated British Foods, the parent company of Primark, noted in an interview with MarketWatch that the company was contemplating a move into eCommerce, although he emphasized that there was no immediate plan to do so. “We have turned our attention to the online channel. If we pursue it, it will be in a form of eCommerce that complements what we currently have,” Bason stated.

According to Primark’s executives, the reason for this stance lies in its low prices; the cost of delivery would erode its margins: “it is all about logistics costs,” Bason affirmed, “the cost of picking, packing, and delivering.” With the strong performance Primark has achieved in its offline channel, Bason stated, “there is not yet an imperative to move into online transactions.”

In this context, the click and collect model could be the ideal approach for Primark. “We are online, we simply do not have eCommerce. Primark has a strong presence on social media,” Bason explained.

The contrast with Shein, Temu, and Lefties

Shein and Temu

Of course, you might think that Primark is not the only fashion company competing on price, and yet many of these competitors sell online. You would be completely correct.

Indeed, in recent years, this segment has become saturated with competition—especially from China, with Shein and Temu. However, the contrast is clear. Both companies have designed their operations from inception specifically for eCommerce:

These companies have the ability to manufacture on demand or in micro-batches. Their algorithms constantly analyze trends on social networks such as TikTok, Instagram, and Pinterest, as well as searches on their own platform. This enables them to quickly identify whatever it is people want to purchase at any given time. When a trend is detected, they manufacture a very small quantity of the product—sometimes just a few hundred units. Furthermore, they control production at the source (mainly in China) and manage returns with policies designed to minimize costs, at times not even requiring the product to be returned.

All this is accomplished without addressing the controversies surrounding their labor practices or how they have leveraged minimis exemptions to minimize their logistics costs.

And what about Lefties?

Earlier in the article, we discussed Inditex. In fact, the Galician company is one of Primark’s competitors in this segment with Lefties, its “low cost” model. This is an interesting example that began as an outlet but today combines physical stores with an active eCommerce presence in Spain and Portugal. In addition, it has digitalized the experience: automated fitting rooms, robotized order pickup, and cashierless payments. Click & collect is free, which reduces costs and ensures foot traffic in stores.

Despite being low cost, Lefties can leverage Inditex Group’s already established digital and logistics infrastructure, allowing it to efficiently manage individual shipments, returns, and inventory shared between stores and online. There is no need to build a supply chain from scratch for eCommerce. It simply integrates with the Group’s pre-existing infrastructure, designed to serve both physical stores and online sales.

The big question

Will Primark be able to remain the king of European low cost if it ignores the segment of the market that never sets foot in a store? Or, to put it differently: what will happen when an entire generation finds it much easier to order a pack of t-shirts from their couch than to spend the afternoon at a shopping mall?

While Shein and Temu fine-tune their algorithms, and Lefties takes an overtly digital approach to the in-store shopping experience, Primark holds firm: the lowest-priced fashions should continue to fly off its racks, not out of a virtual cart.

Image: Primark